|

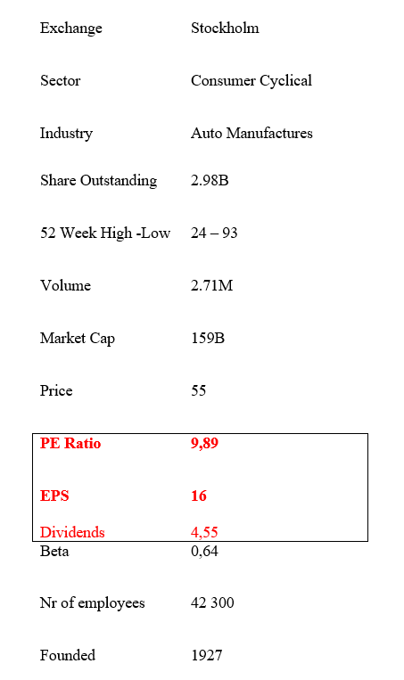

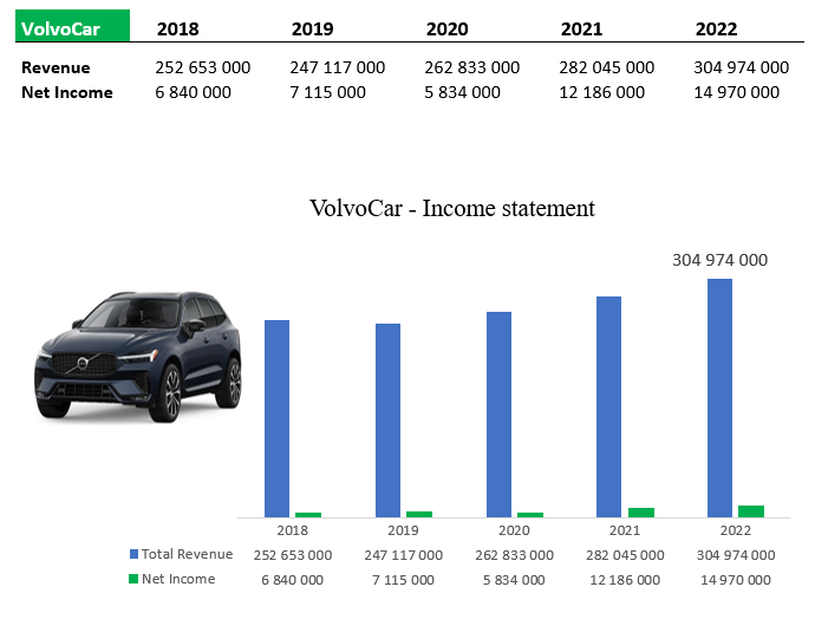

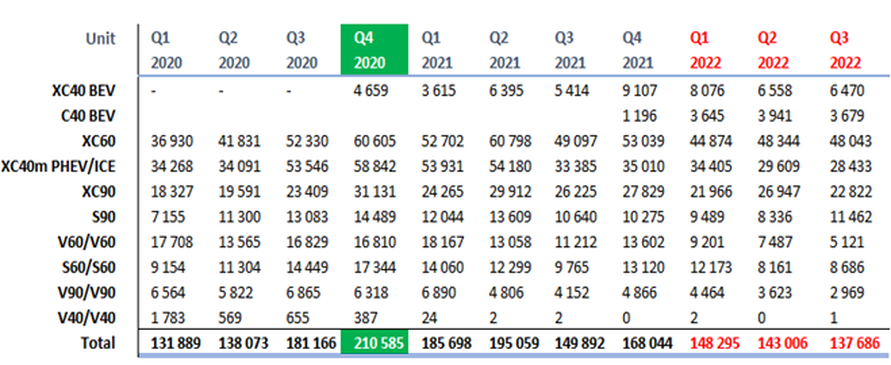

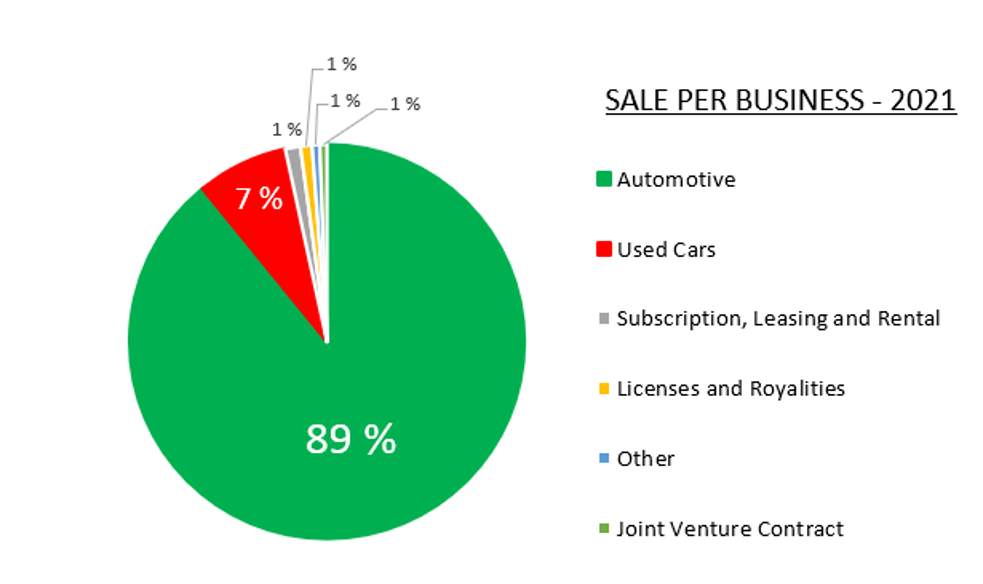

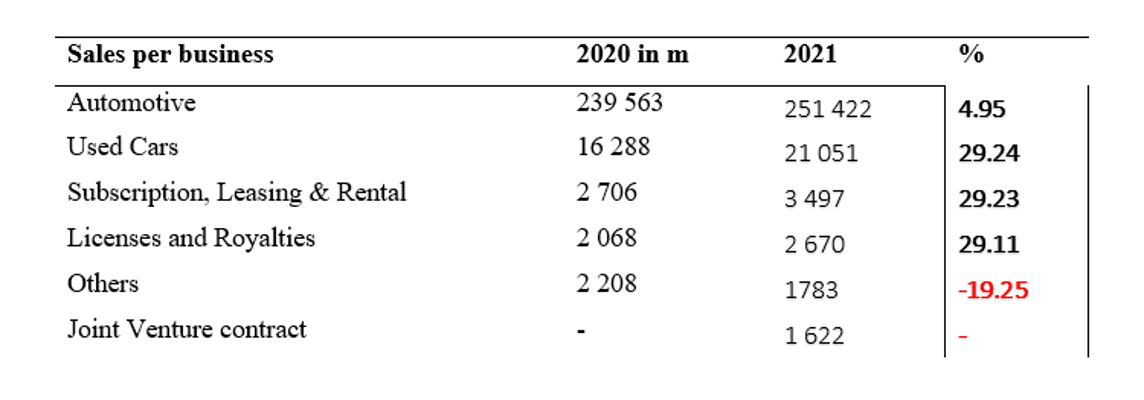

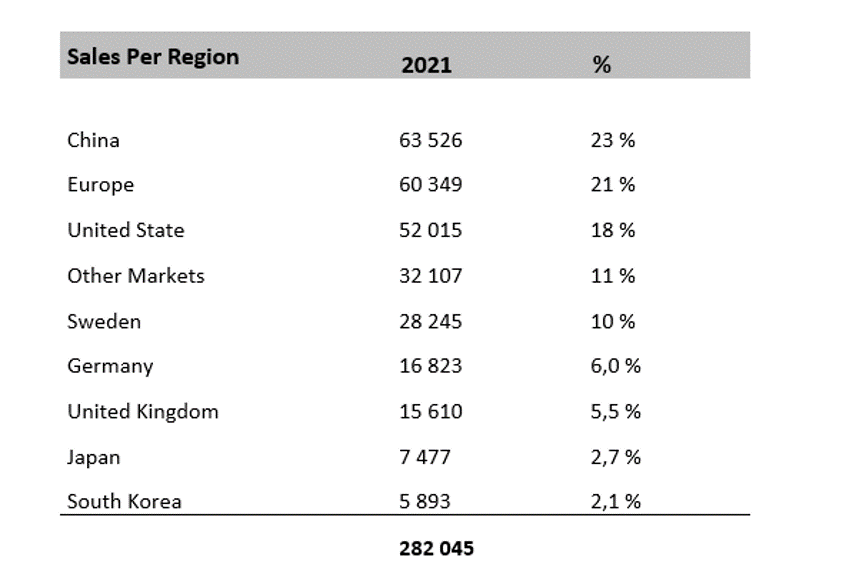

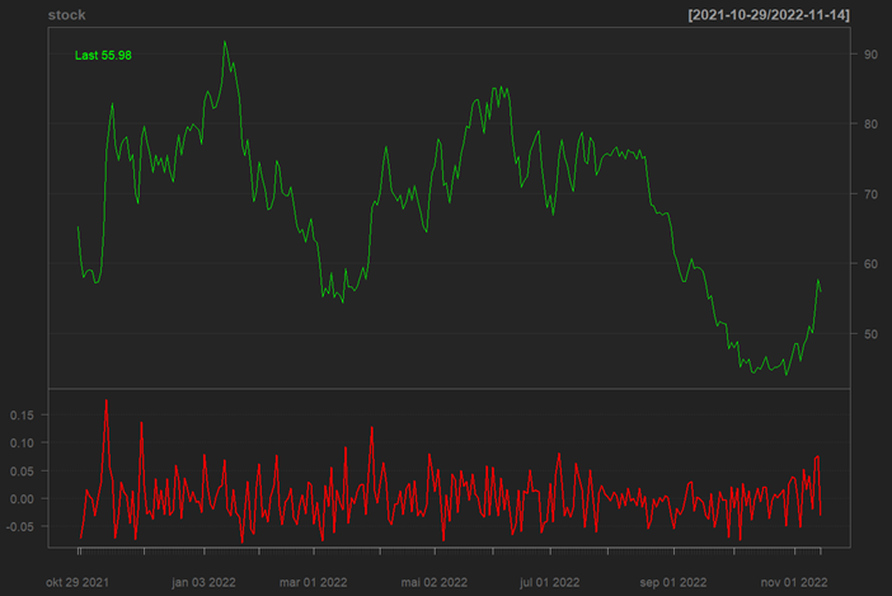

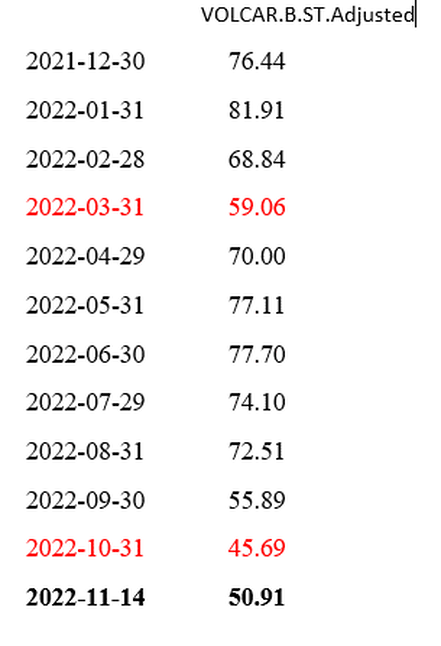

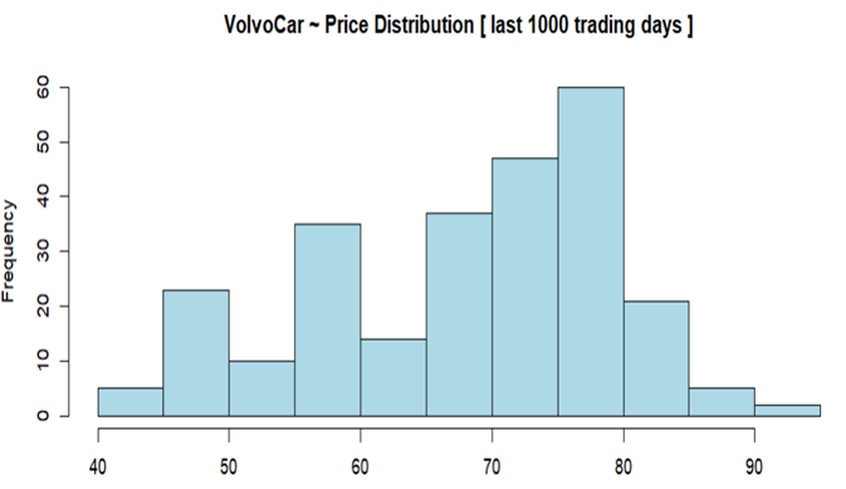

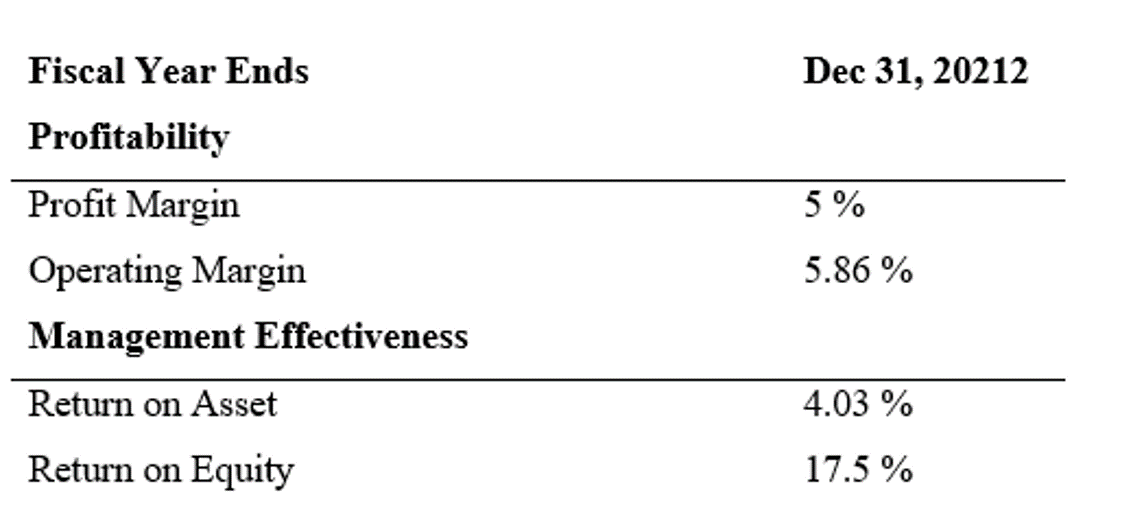

BusinessVolvo Car AB is a Sweden-based automotive brand. Volvo Car Group is focused on the design, engineering, manufacturing, distribution, and sale of passenger cars, with particular focus on sustainability, fully electric cars, and direct consumer relations, including subscription and other new mobility services. Volvo Car Group addressable market is the global premium passenger car market. Moreover, the Company intention is to be a pure electric car company and as a result it is undergoing a shift in its business model to a direct sales model in most of its markets. Volvo Cars commitment to electrification also results in the launch of Polestar, a progressive stand-alone electric performance car brand, in which Volvo Cars owns shares. Volvo Cars also holds shares in the automotive brand LYNK&CO, which focuses on young open-minded urban people through a flexible customer offering. BrandsVolvo Cars is a small producer, with a global market share of 1–2 percent. The largest market, China, represented some 23 per cent of the total sales volume in 2022, followed by Europe (21%), the US (18%), other markets(11%), Sweden(6%), the UK (5.5%), and Germany (6%). Key Data - of VolvoCar stockThe following tables provide a summary of |

Service Disclosure:

Tela operates as an independent equity research and analysis firm. Services from Tela are available solely upon the formalization of a service agreement between the client and Tela. The content presented on this website serves purely for informational purposes. Any guidance or advice offered should be considered as general advice, not taking into account your personal financial circumstances, goals, or needs.

It is important to understand that historical investment performance is not indicative of future results. The returns on investments can be affected by multiple factors such as political dynamics, consumer behavior, market trends, inflation, unforeseen natural disasters, liquidity, market sentiment, and a variety of other risks.

Tela operates as an independent equity research and analysis firm. Services from Tela are available solely upon the formalization of a service agreement between the client and Tela. The content presented on this website serves purely for informational purposes. Any guidance or advice offered should be considered as general advice, not taking into account your personal financial circumstances, goals, or needs.

It is important to understand that historical investment performance is not indicative of future results. The returns on investments can be affected by multiple factors such as political dynamics, consumer behavior, market trends, inflation, unforeseen natural disasters, liquidity, market sentiment, and a variety of other risks.

RSS Feed

RSS Feed