BusinessSafaricom PLC is a leading telecommunication company in East Africa. It provides

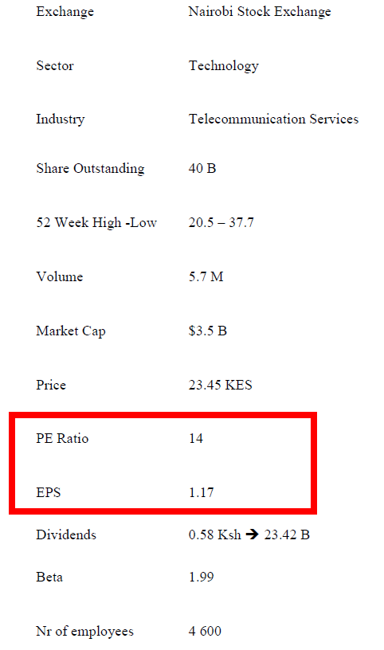

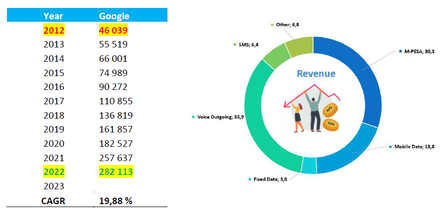

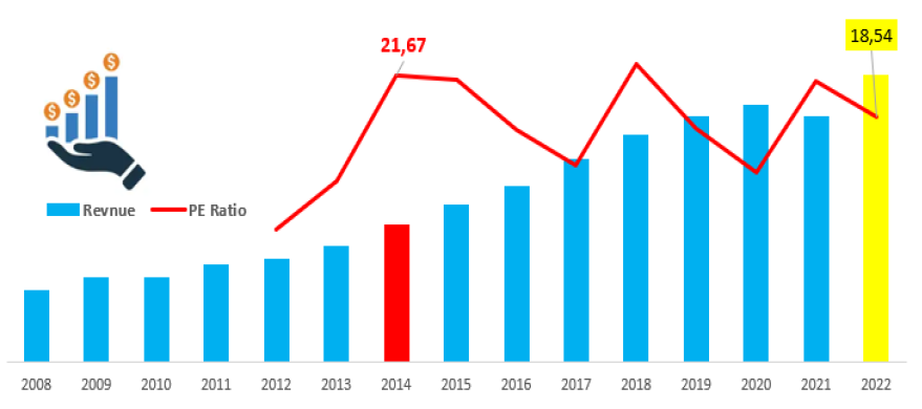

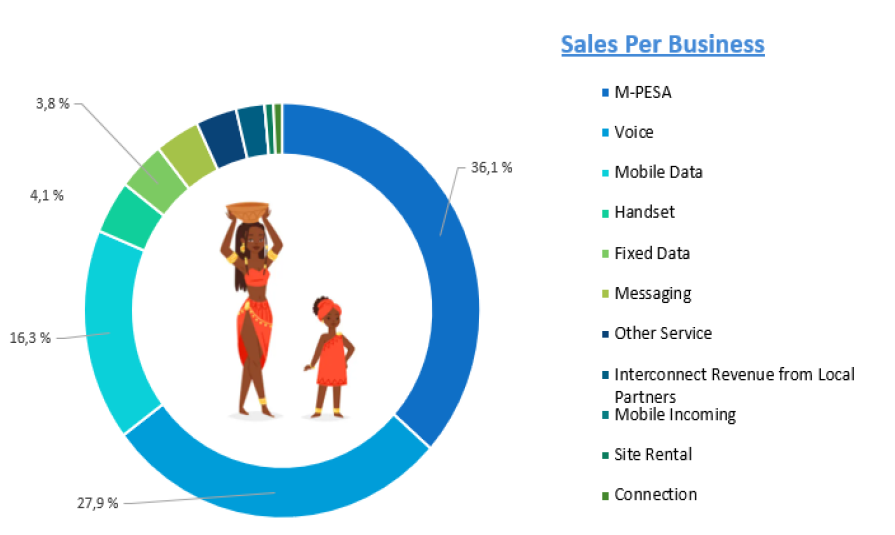

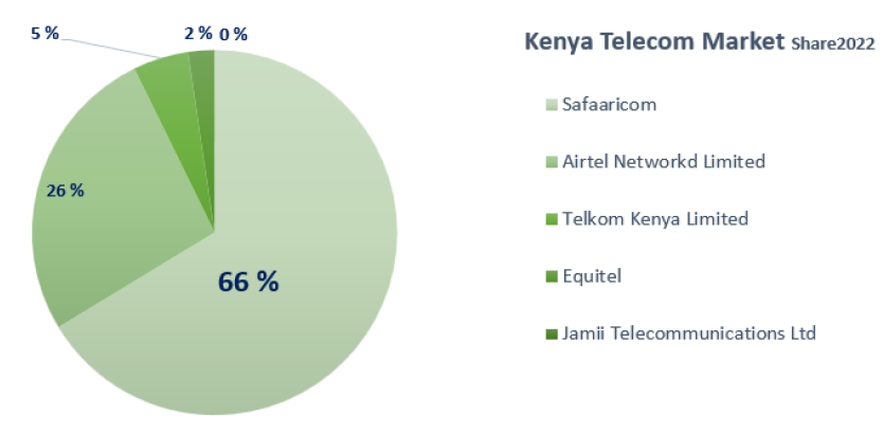

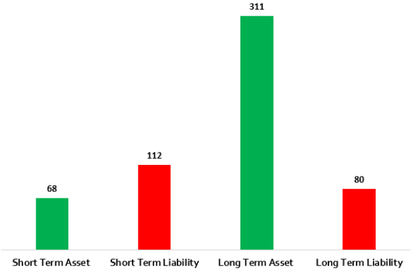

In addition, it provides m-tiba, a health payment application; M Salama platform; FULIZA, an overdraft facility that allows customers to complete their transaction in case of insufficient funds; M-Shwari, a micro-lending/savings product; M-Kesho, an equity bank account; and Shupavu291, an education platform that enables students to study without an internet connection. The company serves individual, corporate, and SME customers, as well as government agencies. It sells its products and services through dealers and retail outlets. Safaricom PLC was incorporated in 1997 and is based in Nairobi, Kenya. As today Safaricom PLC serves over 42 million customers connected and play a critical role in the society, supporting over one million jobs both directly and indirectly while our total economic value was estimated at KES 362 Billion ($ 3.2 billion) for the 12 months through March 2021. They are listed on the Nairobi Securities Exchange (NSE) and with annual revenues of close to KES 298 Billion ($2.5 billion) as at March 2022. Safaricom Plc. Stock price fluctuationsStock prices are driven by a variety of factors, but ultimately on the long-term horizon stock price are driven by earnings power and the managers ability to create values for every dollar that deployed. Current Safaricom's stock prices as 13 March 2023 are at the level of 2017 and 2019. HOW DOES SAFARICOM Plc. MAKE MONEY ?CAGRs are useful since they reduce the effect of volatility in specific periods, unlike arithmetic means. We can find the calculation details for Safaricom’s Revenue CAGR outlined below. The calculation starts by listing values for Revenue for the last ten fiscal years that are required to calculate CAGR: Price to Earnings Ratio vs IndustrySafaricom ~ Price-To-Earnings vs Peers: SCOM is good value based on its Price-To-Earnings Ratio 14x compared to the peer average 24.2x. What do they offer ? CompetitorsThe Kenya Telecom Market is expected to witness growth CAGR of 2.00% during the forecast period of 2021 to 2026, this is approximately a valuation of $3.5 billion. Most of the major telecom companies in Kenya, such as Safaricom, Airtel, and Telkom, are promote innovation by making significant R&D investments consistently. The Kenya’s telecommunication sector, which underpins the operations of all enterprises, public safety groups, and the government, is a crucial part of the country's economy. The number of active mobile subscriptions as 31 March 2023 stood at 61.4 million, representing an increase of 2.6% from the preceding quarter. Subsequently, mobile (SIM) penetration grew, by 3.3% points to stand at 129.1% during the period under review. During the same period, the data for Jamii Telecommunications Limited – a privately owned Kenyan telecommunication service provider offering broadband and mobile services under the "FAIBA" brand – is included in cellular mobile services sub-section which main services are delivering mobile data through 4G but also include Voice over LTE (VoLTE). Financial HealthSafaricom celebrated the 15th anniversary of the introduction of M-PESA with various awareness campaigns. With its over 30 million monthly active customers, more than 3.2 million businesses, and over 42,000 developers engaged in ongoing development within the Super Apps, some 50 million transactions per day, and a velocity of funds exceeding KShs 2 trillion monthly, M-PESA truly constitutes a massive ecosystem whose potential is only just beginning to make itself felt.

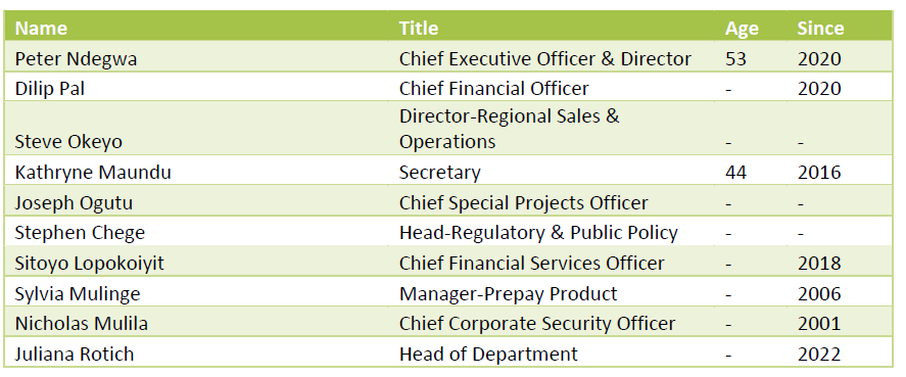

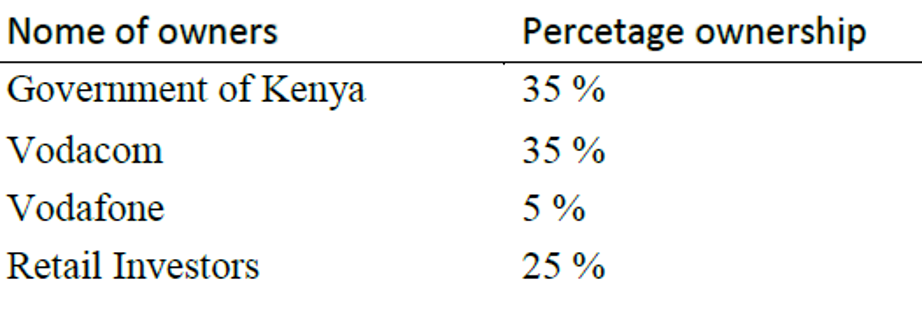

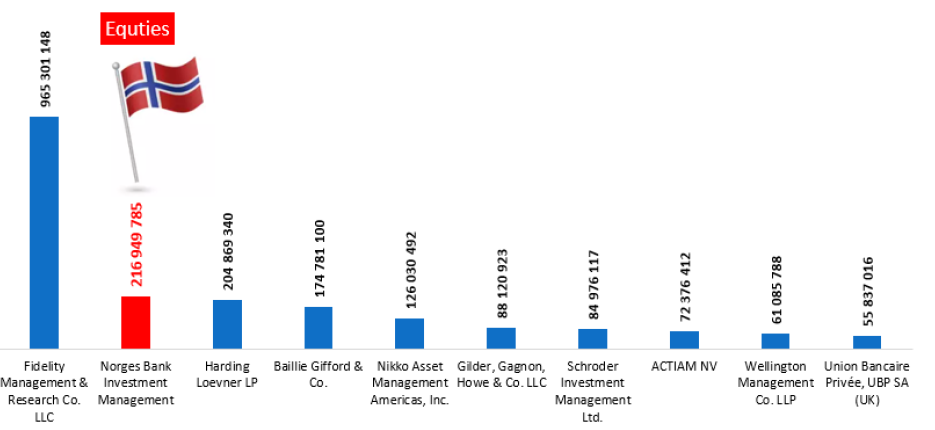

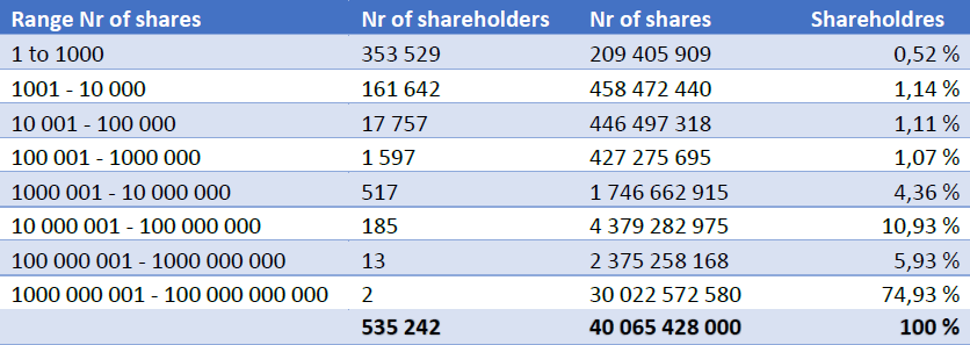

ManagementAverage management tenure 2.3 years. CEO – Peter Nfegwa (53 years young): have 2.9 years tenure, with a compensation of KSH 288 930 000. Mr. Peter Waititu Ndegwa has been Chief Executive Officer and Executive Director of Safaricom PLC since April 1, 2020. He serves as the Chief Executive Officer of Safaricom PLC. at Vodacom Group Limited since April 1, 2020. He served as the Chief Executive Officer and Managing Director of Guinness Nigeria Plc from September 4, 2015 until June 30, 2018. Mr. Ndegwa served as Managing Director of Guinness Ghana Breweries Ltd. until July 20, 2015. Mr. Ndegwa served as Group Finance Director of East African Breweries Ltd., since August 28, 2008 and served as its Managing Director of Serengeti Breweries Limited. He was responsible for Diageo PLC operations in 50 countries in Western and Eastern Europe, Russia, Middle East and North Africa regions. Mr. Ndegwa has experience in sales, Financial Services, General Management, Fast Moving Consumer Goods (FMCG), Business strategy, Finance Operations, business advisory and finance in a variety of sectors including retail, manufacturing, banking and insurance and general services. He joined EABL as Head of Group Strategy in January 2004 and Change Director Sales since March 2006, Head a radical change programme within the sales and commercial area. He served as EABL Sales Director of Kenya. He trained and worked with PricewaterhouseCoopers, in a variety of senior roles both in Eastern Africa and in the UK and served as an Associate Director in the Corporate Finance and Strategy practice. He holds an MBA in Strategy and Finance from the London Business School and an Economics degree from the University of Nairobi. He is also a Certified Public Accountant. Ownership Safaricom were founded in 1997 as a fully owned subsidiary of Telkom Kenya before a 40 percent acquisition by Vodafone Group PLC in May 2000, and a public offering of 25 percent shares through the NSE in 2008. Distribution of shareholders

0 Comments

Leave a Reply. |

Service Disclosure:

Tela operates as an independent equity research and analysis firm. Services from Tela are available solely upon the formalization of a service agreement between the client and Tela. The content presented on this website serves purely for informational purposes. Any guidance or advice offered should be considered as general advice, not taking into account your personal financial circumstances, goals, or needs.

It is important to understand that historical investment performance is not indicative of future results. The returns on investments can be affected by multiple factors such as political dynamics, consumer behavior, market trends, inflation, unforeseen natural disasters, liquidity, market sentiment, and a variety of other risks.

Tela operates as an independent equity research and analysis firm. Services from Tela are available solely upon the formalization of a service agreement between the client and Tela. The content presented on this website serves purely for informational purposes. Any guidance or advice offered should be considered as general advice, not taking into account your personal financial circumstances, goals, or needs.

It is important to understand that historical investment performance is not indicative of future results. The returns on investments can be affected by multiple factors such as political dynamics, consumer behavior, market trends, inflation, unforeseen natural disasters, liquidity, market sentiment, and a variety of other risks.

RSS Feed

RSS Feed