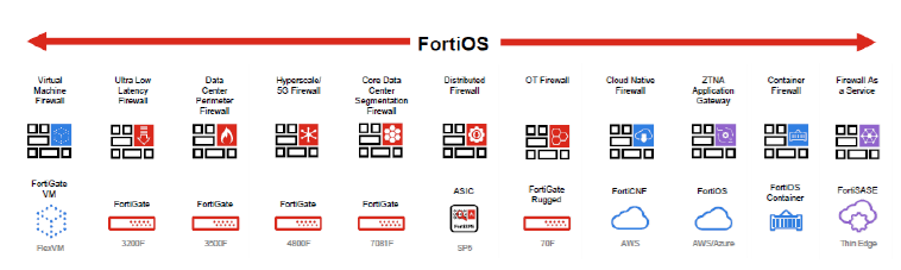

BusinessIn the world of cybersecurity, Fortinet, Inc. stands out as a comprehensive provider of advanced, seamlessly integrated security solutions. Spanning a global footprint that covers the Americas, Europe, the Middle East, Africa, and the Asia Pacific, Fortinet's offerings are a testament to its broad and automated approach to safeguarding digital assets and networks. Business activities covers.

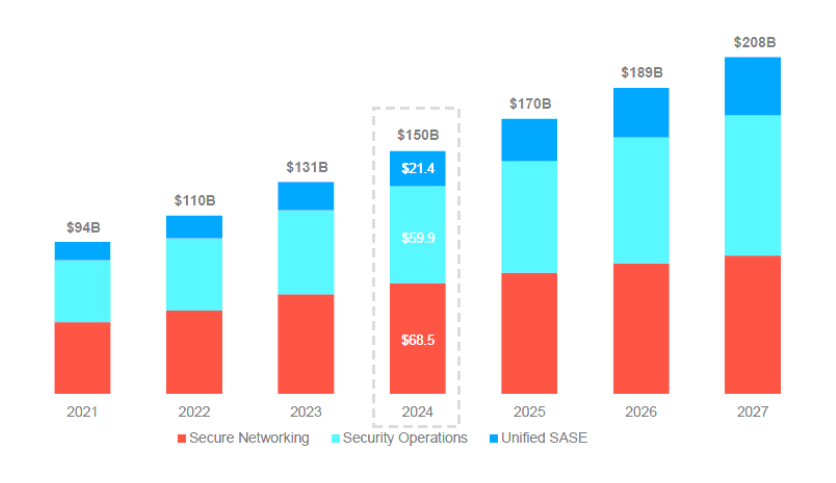

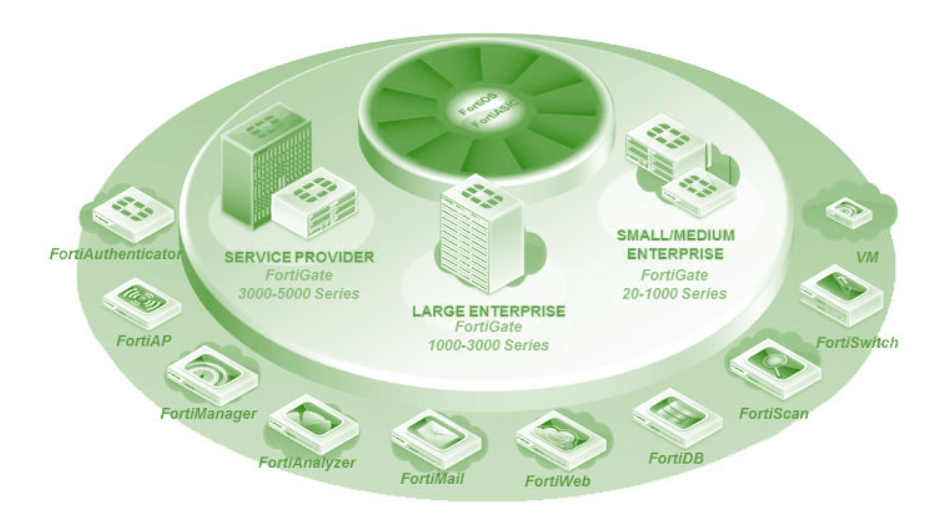

Total Addressable Market: $150B, Growing to $208B by 2027Diving deeper into Fortinet's portfolio, the company also offers the FortiSwitch series, designed to provide secure switching solutions that facilitate the connection of end devices in a protected manner. For organizations seeking robust wireless networking solutions, Fortinet's FortiAP series comes into play, while the FortiExtender offers a hardware appliance dedicated to extending the reach of secure networks. On the analytics and management side, Fortinet introduces the FortiAnalyzer and FortiManager product families, aimed at centralizing network logging, analysis, reporting, and scalable management of its FortiGate products, respectively. Not stopping there, Fortinet's FortiWeb series caters to the need for web application firewall solutions, and the FortiMail series offers secure email gateway solutions. For proactive detection and mitigation, Fortinet's FortiSandbox technology is a game-changer, complemented by FortiClient's endpoint protection capabilities that include pattern-based anti-malware, behavior-based exploit protection, web filtering, and an application firewall. Ensuring secure access and authentication, Fortinet provides the FortiToken and FortiAuthenticator product families, alongside the FortiEDR/XDR for cutting-edge endpoint protection that combines comprehensive machine-learning anti-malware execution with real-time post-infection protection. Beyond product offerings, Fortinet prides itself on delivering top-notch

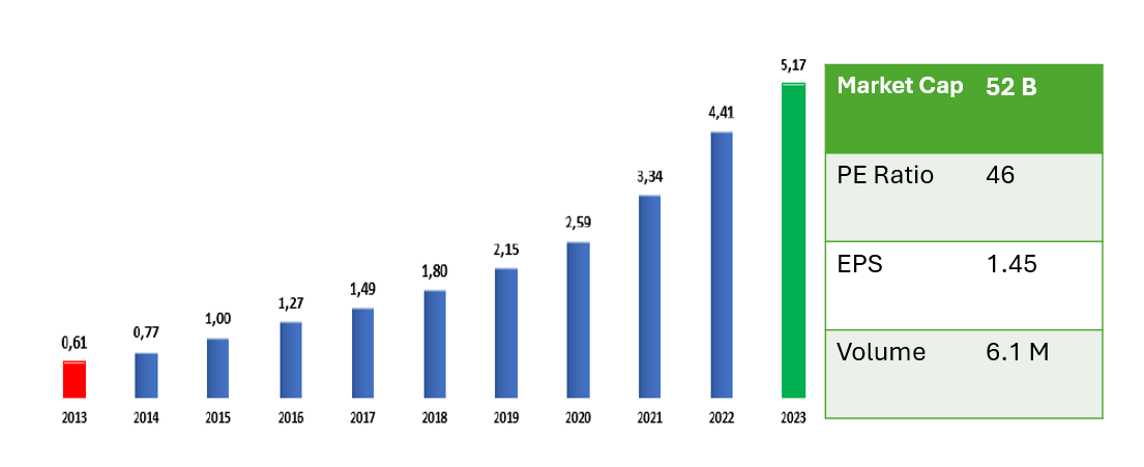

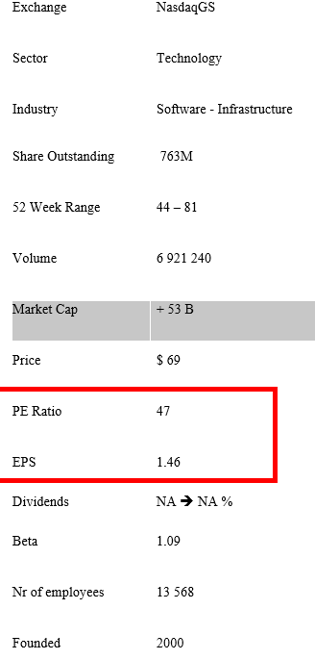

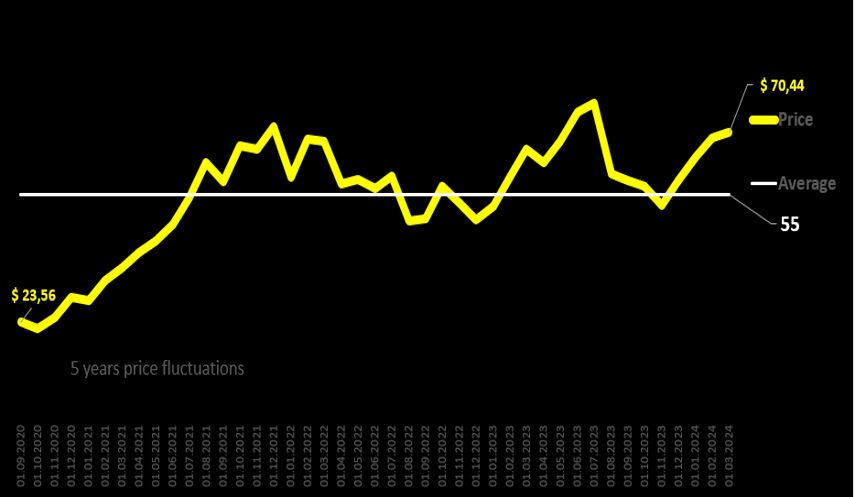

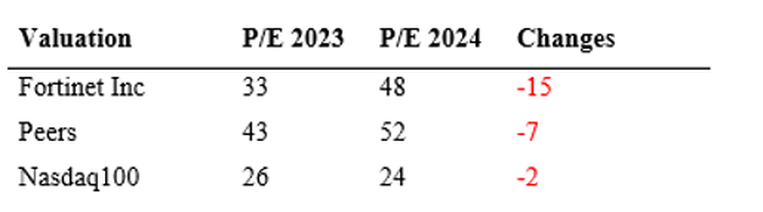

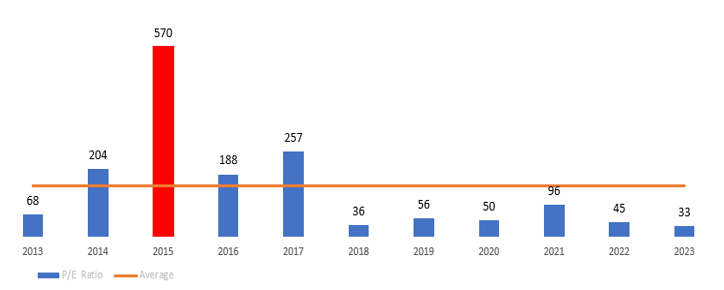

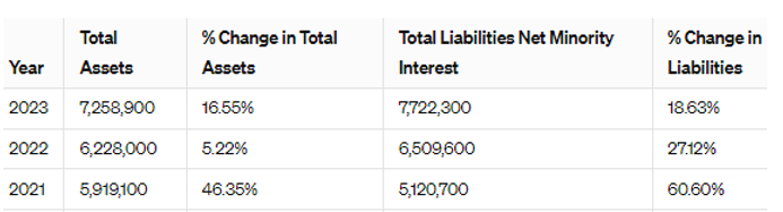

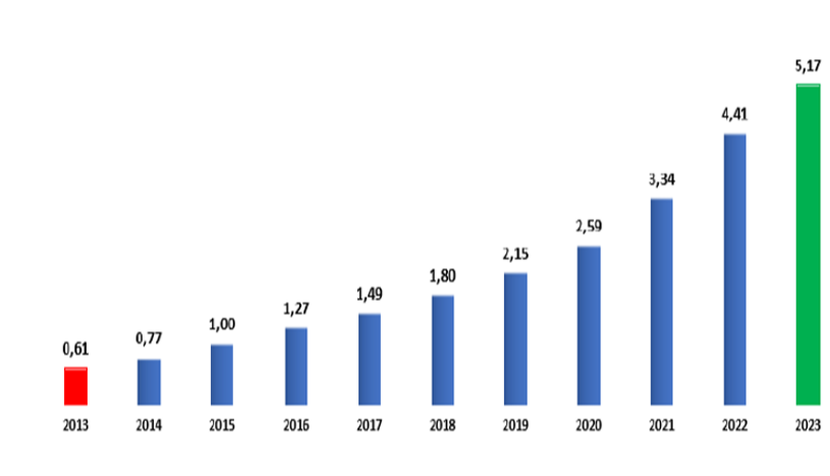

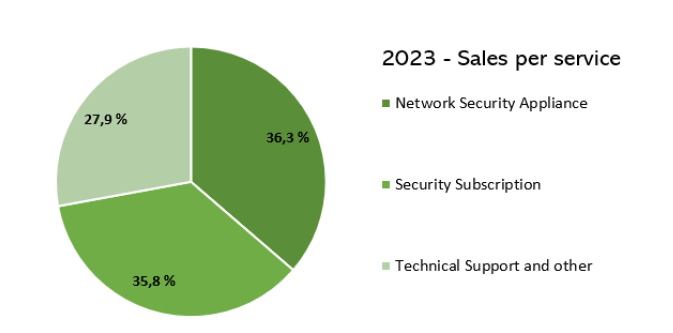

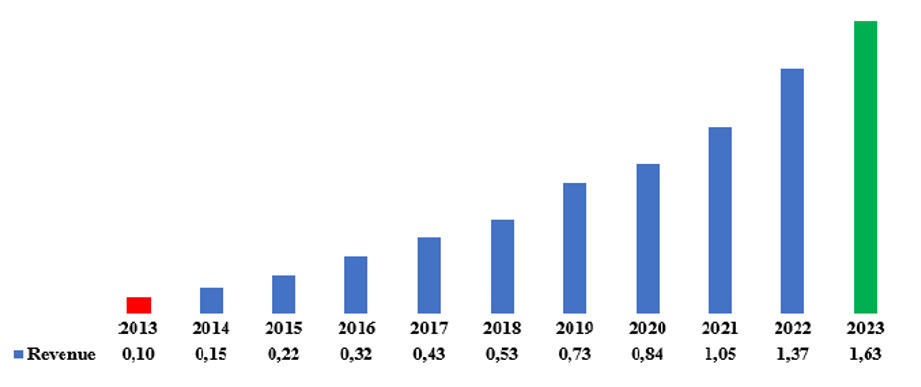

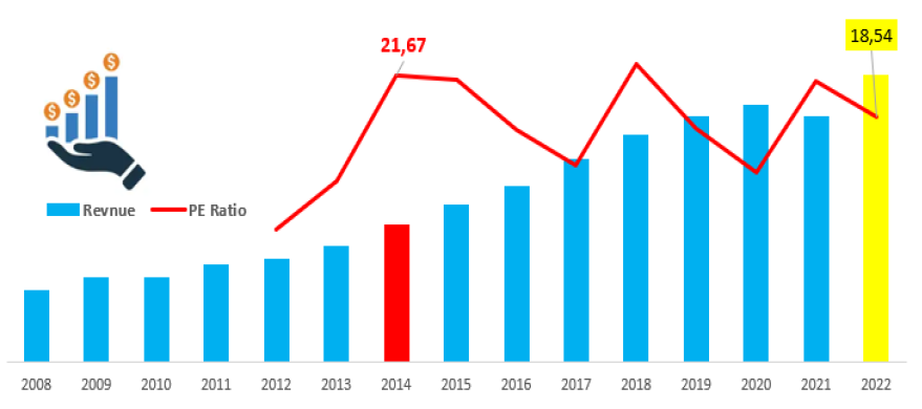

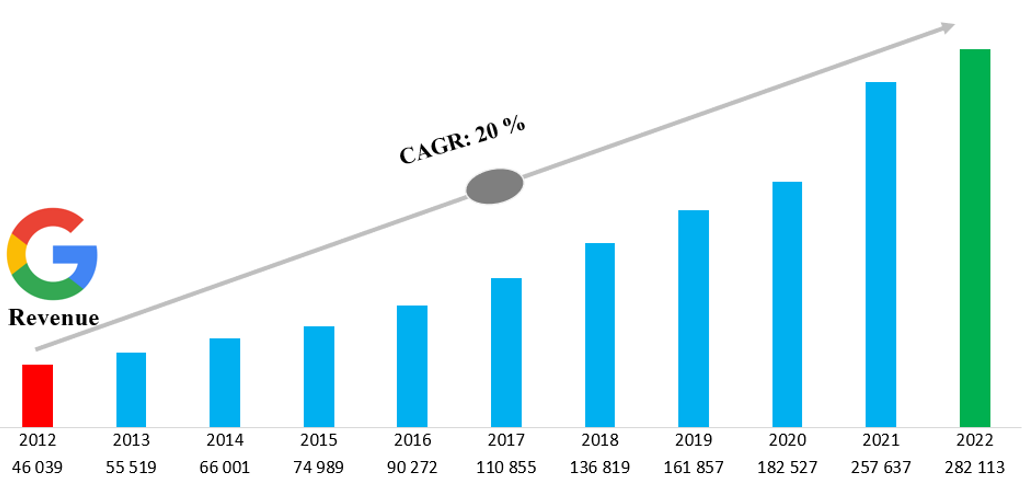

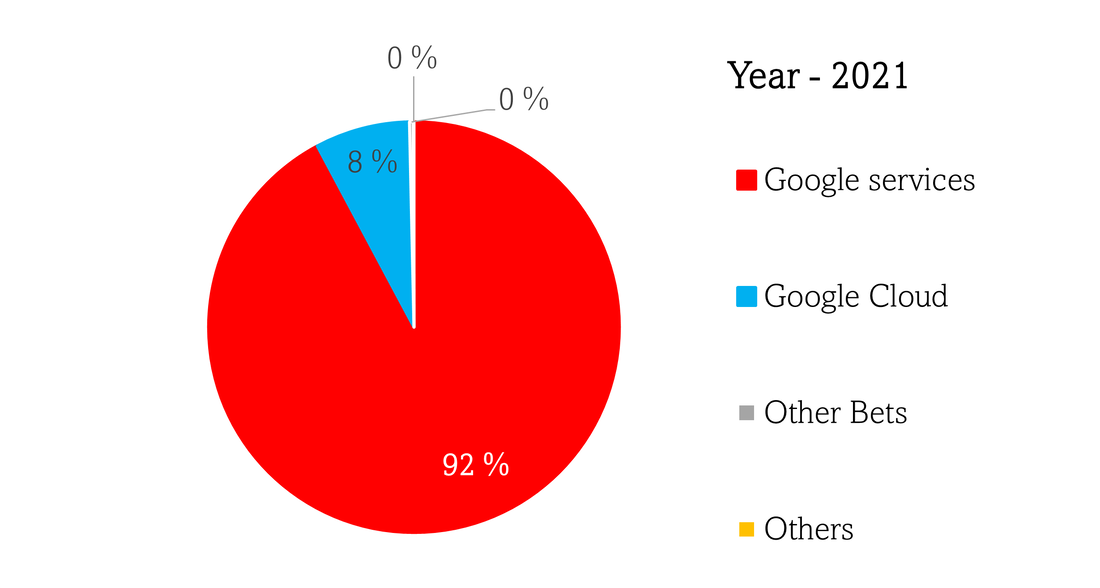

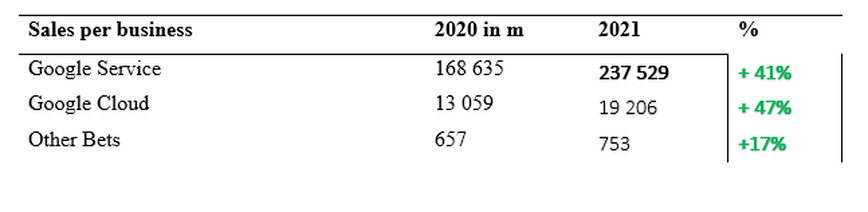

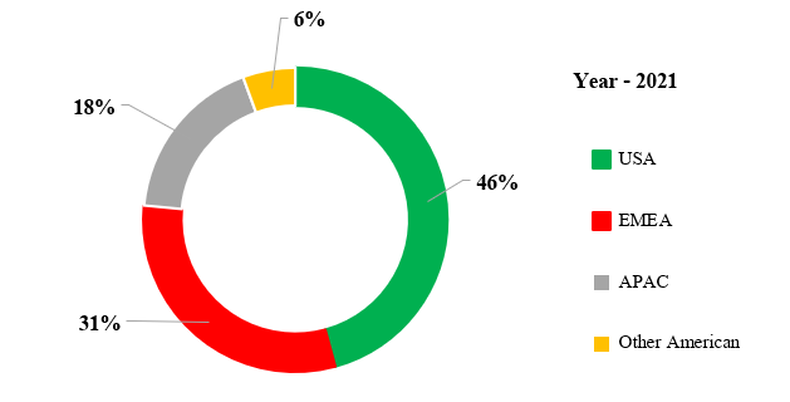

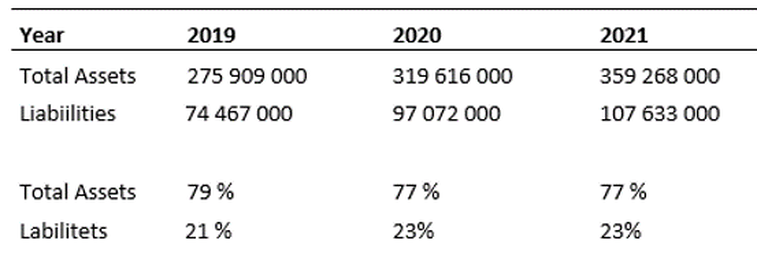

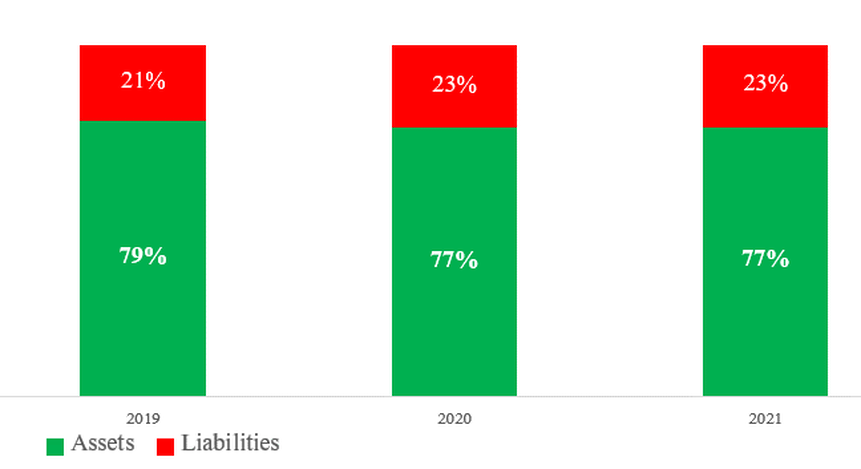

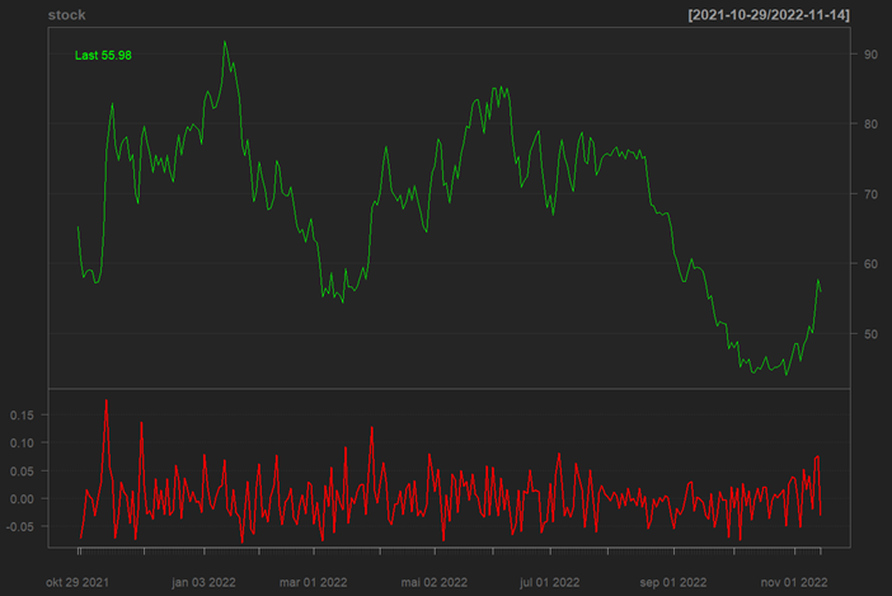

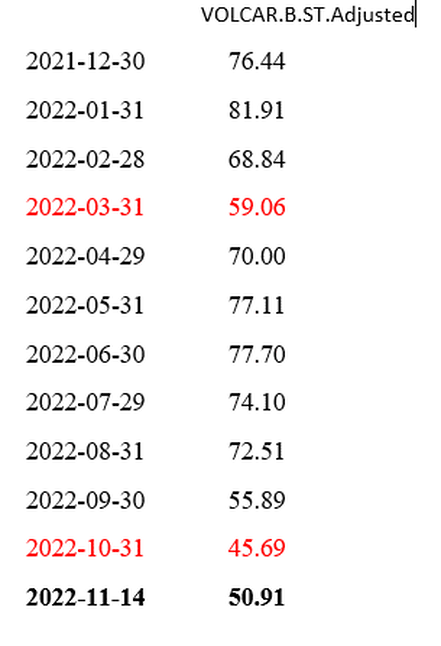

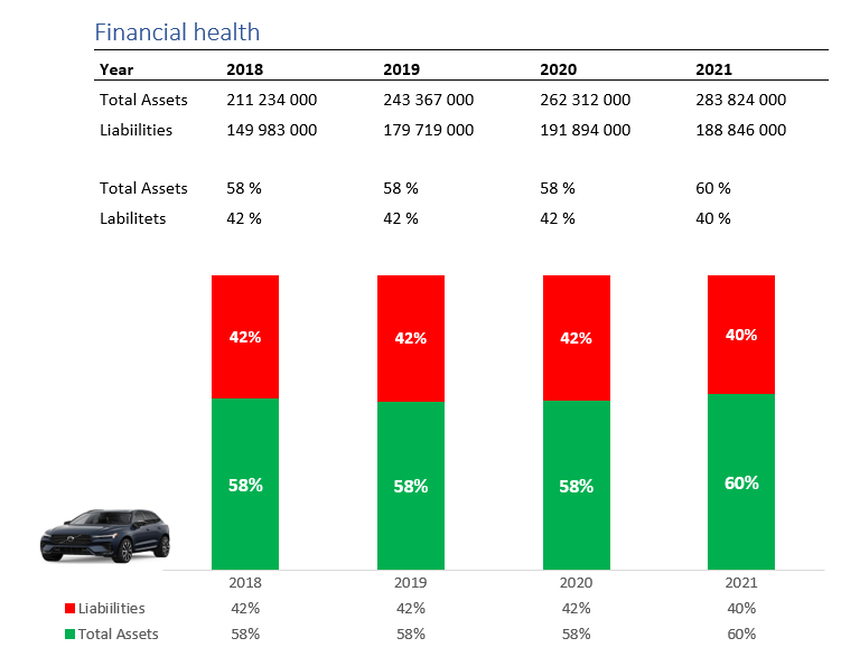

Key DataFortinet’s 1250 trading days - stock price fluctuationsHistorical daily share price chart and data for the Fortinet since 01-09-2020 adjusted for splits. The latest closing stock price for Fortinet as of March 01, 2024, is $70. The all-time high Fortinet stock closing price was $79 on 01 June 2023. Fortinet five years average stock price is $55, which is -21% lower than the current share price. ValuationsOn a trailing basis, Fortinet currently trades at multiples of 9.9x EV/sales, 35x EV/EBITDA, and 48x P/E. The Price-to-Earnings (P/E) ratio) for Fortinet Inc. stands out good valued when compared to its peers, positioned at approximately 48.00, which is considerably lower the median of its comparison group. This places Fortinet Inc.'s market valuation slightly lower than that of its peer group. However, when comparing the current P/E ratio of Fortinet Inc. to its own 10-year historical average of 154.0, it's observed to be significantly lower. This suggests that Fortinet Inc.'s current market valuation is in alignment with its historical valuation trend over the last five years. Fortinet Inc., renowned for its contributions to cybersecurity and the integration of networking and security solutions globally, showcases impressive financial strength. With a Return on Equity (ROE) reaching 845% and a Return on Assets (ROA) at 17%, these figures underscore the company's adeptness in utilizing its equity and assets to drive. profitability. Such performance not only reflects the company's current financial health but also indicates a strong potential for sustained growth in the future. Fortinet stands out in the cybersecurity field, achieving a notable profit margin of 21.64% and an operating margin of 27.15% over the trailing twelve months. These margins highlight Fortinet's efficiency in managing its operations and converting sales into net income, illustrating the company's financial health and operational excellence. Such performance is indicative of Fortinet's strong position in the market and its ability to maintain profitability, underscoring its potential for continued success. Financial HealthA table displaying the year-over-year percentage changes for both Total Assets and Total Liabilities Net Minority Interest from 2020 to TTM. Fortinet’s Platform Approach to Cyber Security 10 years - Fortinet Inc. Income StatementsFortinet Inc. has shown impressive revenue growth from 2013 to 2023, increasing from $0.61 billion to $5.30 billion. This growth highlights Fortinet's strong position and expanding market share in the cybersecurity sector. The company's annual revenue growth rate of 20.09% in 2023 indicates a consistent upward trajectory, emphasizing its success in responding to increasing cybersecurity demands. For detailed revenue history and growth analysis, visit Stock Analysis. Highly Diversified Business CompetitorsFinancial Risk Industry Average time from detection to remediation

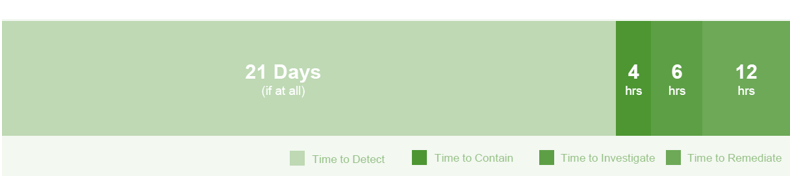

This statistics highlight the significant challenges that organizations face in detecting, containing, investigating, and remediating cybersecurity incidents. These observation reflect a broader trend in cybersecurity operations and the critical importance of rapid response to mitigate the impact of cyberattack. Moreover, the recovery from a cyberattack can be a lengthy process, with an average of 277 days required to fix the damage from a cyber incident. Organizations that have experienced more than one data breach report that 57% have passed the incident costs onto their consumers, yet only 51% have increased security investments. This reflects a gap in response that could exacerbate vulnerabilities and costs associated with cyber incidents. The role of human error in cybersecurity breaches is significant, with 82% of breaches involving a human element. This emphasizes the need for comprehensive cybersecurity training and awareness programs to mitigate risks associated with phishing attacks, weak passwords, and sharing sensitive information over unsecured channels. Data breach response times and their impact on costs and reputation are critical considerations for organizations. The faster a data breach is identified and contained, the lower the costs associated with it. Companies with dedicated, trained teams and tested response plans respond faster and more effectively to cyber incidents. Security automation can decrease the average response time, while IoT devices have been found to increase the average cost of a data breach due to their vulnerabilities. New SEC Rule 4 Days to disclose material cybersecurity. The Securities and Exchange Commission (SEC) has introduced new rules aimed at enhancing and standardizing disclosures regarding cybersecurity risk management, strategy, governance, and incidents by public companies. These rules, adopted on July 26, 2023, are part of an effort to provide investors, companies, and the markets with more consistent, comparable, and decision-useful cybersecurity information. The main highlights of these new rules are as follows: By 2026, more than 60% of organizations will have more than one type of firewall deployment, which will prompt adoption of hybrid mesh firewalls.” SWOT AnalysisThe company exhibits strong foundational elements. It surpasses over 70% of other companies in terms of a balanced blend of growth, profitability, debt management, and market presence. However, from a short-term investment standpoint, the company's fundamental outlook has worsened.

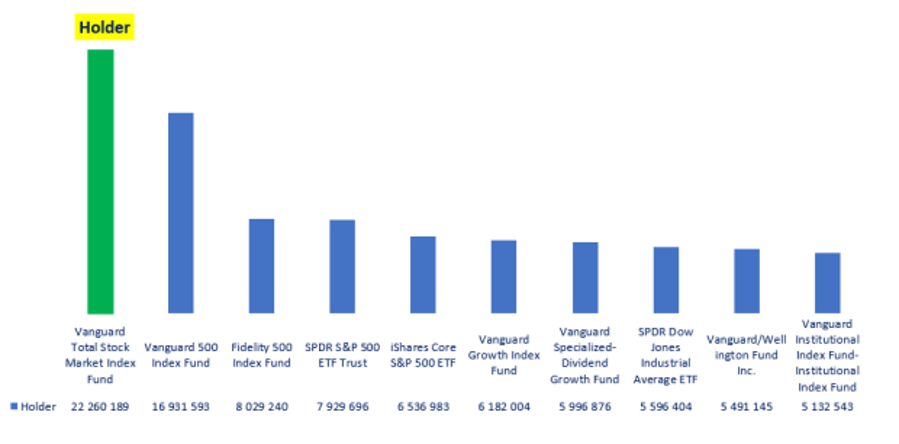

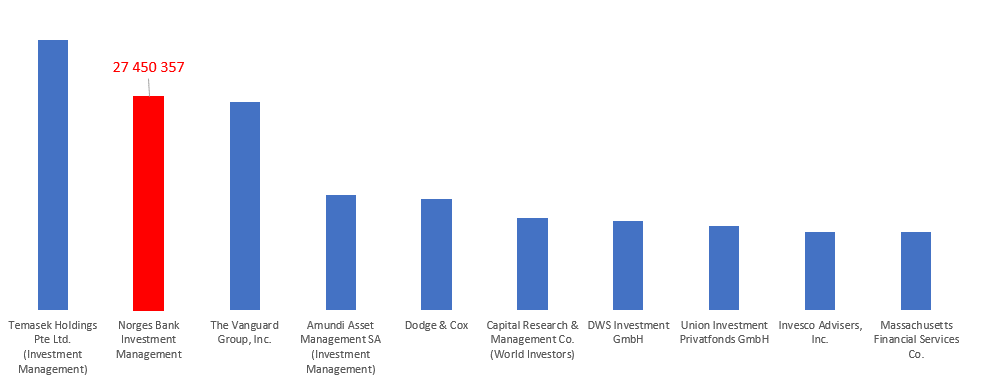

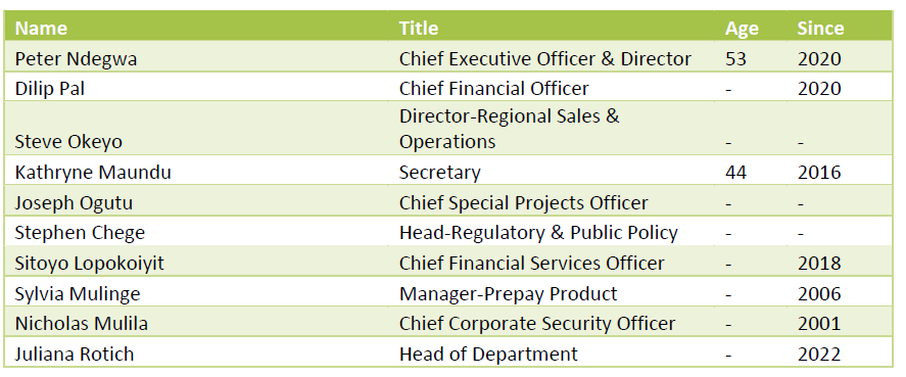

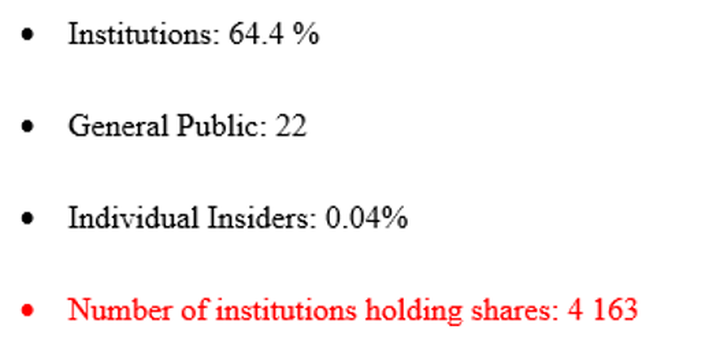

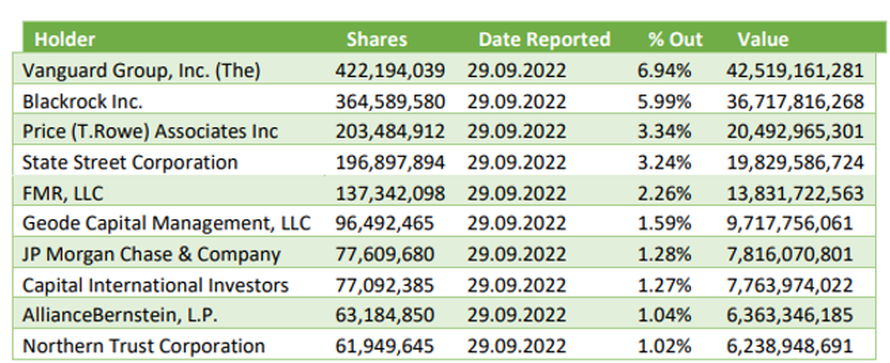

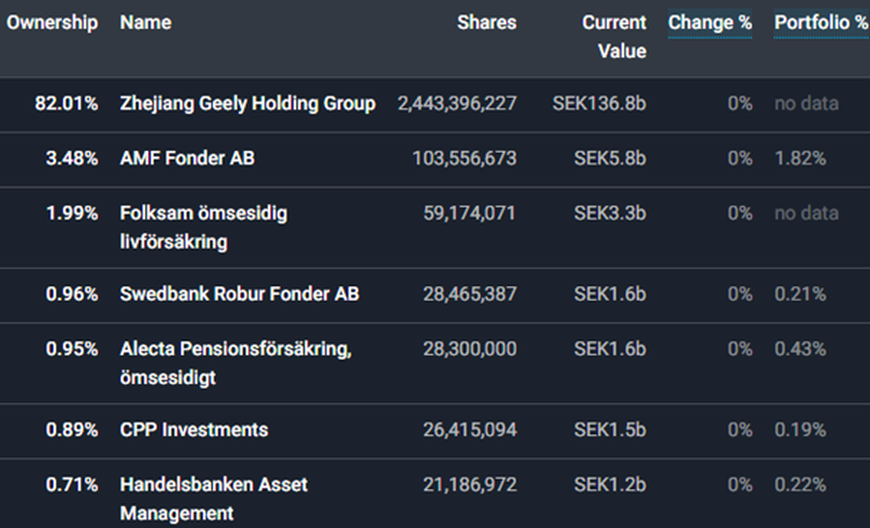

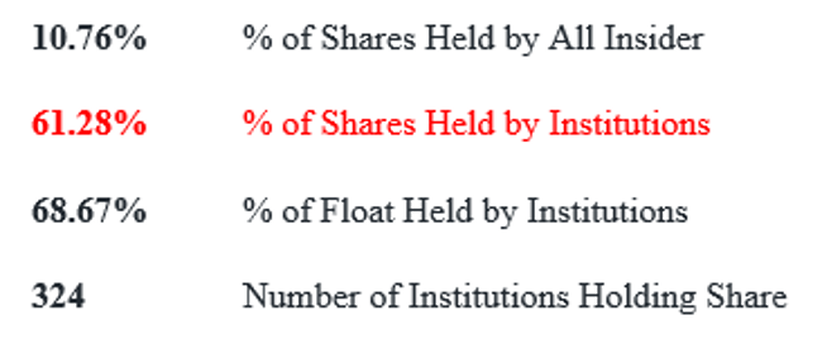

ManagementKen Xie, 60, is the Founder, CEO, and Director of Fortinet, Inc., a role he has held since October 2000, with a tenure of 23.4 years and a compensation of US$14.2 million. He has a rich background in networking and security industries, including founding NetScreen Technologies and serving as President of Fortinet. Xie's contributions to the tech industry have earned him numerous accolades, including being named a Technology Pioneer by the World Economic Forum. He holds advanced degrees in electrical engineering from Tsinghua University and Stanford University. Xie's early entrepreneurship began with SIS in 1993, leading to significant recognition in the tech and engineering fields, including awards from the World Economic Forum and Ernst & Young. He holds degrees from Tsinghua University and Stanford University. OwnershipThe ownership structure of Fortinet Inc:

0 Comments

BusinessPaycom is a leader in the human capital management/payroll software industry that continues to take market share from long-standing incumbents. Customers love Paycom for its integrated software offering with robust self-service capabilities and the excellent service the Paycom team delivers. The company has a highly repeatable sales process and a solid track record for selling more to existing customers while acquiring new users. Paycom is an emerging leader in a large addressable market where they believe they are only just beginning to scratch the surface. Paycom Software, Inc. provide a comprehensive, cloud-based human capital management (HCM) solution offered as a Software-as-a-Service. The solution offers.

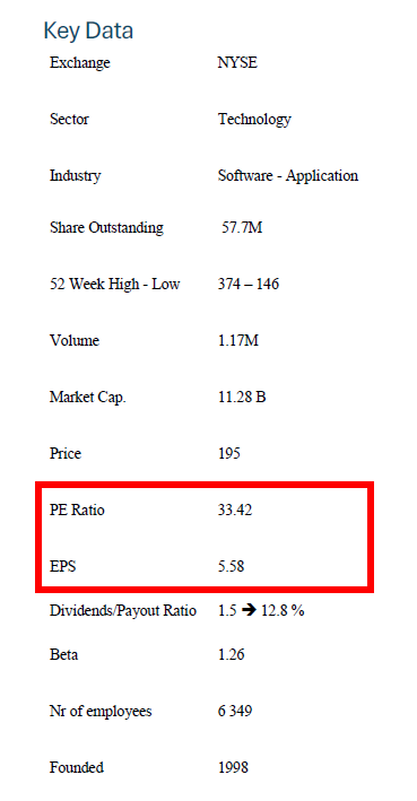

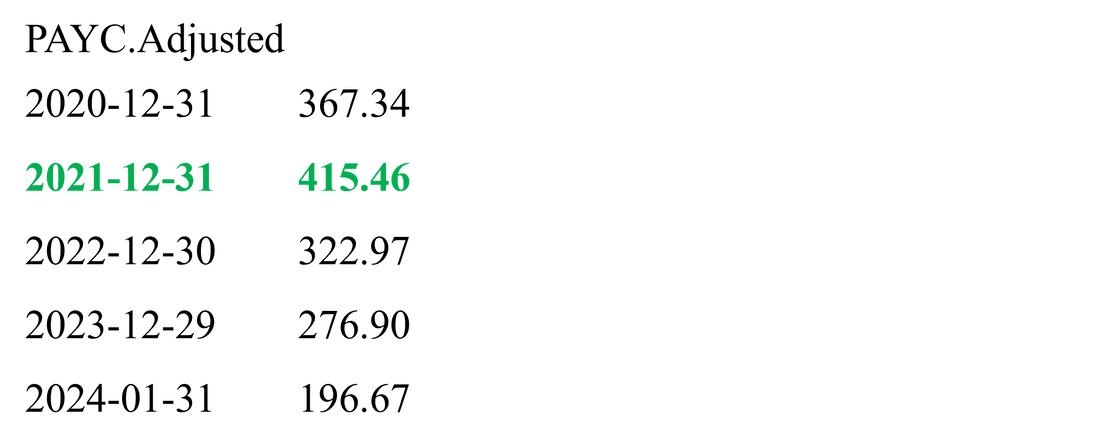

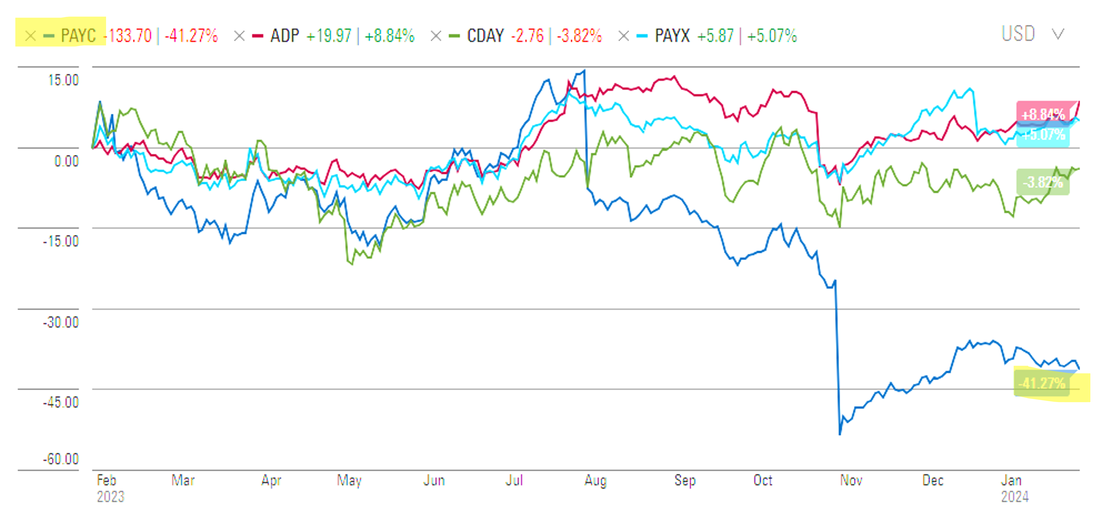

Key DataPaycom’s 1250 trading days - stock price fluctuationsHistorical daily share price chart and data for the Paycom Software since 01-08-2020 adjusted for splits. The latest closing stock price for Paycom Software as of February 01, 2024, is $190.

ValuationOn a trailing basis, Paycom currently trades at multiples of 6.5x EV/sales, 18x EV/EBITDA, and 33x P/E. Given the growth profile of the business, it makes sense to value Paycom using a DCF approach as well. The company has a diluted share count of 57 million, that vest upon Paycom achieving an enterprise value of $10 billion. Paycom Software, Inc., a prominent cloud-based human capital management software provider, exhibits strong financial performance with a Return on Equity (ROE) of 27%, Return on Assets (ROA) of 9%. These metrics highlight the company's effective use of equity and assets to generate profit and its significant potential for continued growth. Revenue Key drivers Paycom’s revenue streaming is diversified across several operational areas including talent acquisition, time and labor management, payroll, talent management, HR management, and Global HCM applications. Additional revenue streams come from fees associated with form filings and the delivery of client payroll checks and reports. . Talent Acquisition:Paycom talent acquisition segment contributes significantly to Paycom recurring revenue through various applications: - Applicant Tracking - Candidate Tracker - Enhanced Background Checks® - Onboarding - E-Verify® - Tax Credit Services 2. Time and Labor Management:This segment includes a range of tools and applications that streamline time and labor processes: - Time and Attendance - Scheduling/Schedule Exchange - Time-Off Requests - Labor Allocation - Labor Management Reports/Push Reporting® - Geofencing/Geotracking - Microfence 3. Payroll:Paycom payroll services are comprehensive, encompassing: - Beti - Payroll and Tax Management - Vault - Everyday™ - Paycom Pay - Expense Management 4. Talent Management:Talent management is another critical area, with applications including: - Employee SelfService® - Compensation Budgeting - Performance Management - Position Management - My Analytics - Paycom Learning and Content Subscriptions 5. HR Management:The HR management segment offers a variety of tools to assist in human resPaycomces tasks: - Manager on-the-Go® - Direct Data Exchange® - Documents and Checklists - Government and Compliance - Benefits Administration/Benefits to Carrier - Benefit Enrollment Service - COBRA Administration - Personnel Action Forms - Performance Discussion Forms - Surveys - Client Action The diverse and robust nature of Paycom recurring revenue streams, underlining the company's strength in delivering a wide range of applications and services across various sectors of business operations. This diversification not only stabilizes Paycom revenue streams but also positions us to capitalize on multiple aspects of the growing digital business solutions market. The following tables provide a summary of |

| An important aspect in this field is regulation: in some places, existing regulations for traditional casinos do not apply to online casinos. Dealing with regulation and its changes is a key factor to position the business for growth and stay compliant. Europe is the most advanced and mature geographical area in the business of online casinos both in terms of demand and regulation. There, EVO has established a stable leading position (50-60% estimated market share). EVO is pursuing a structured expansion strategy in the US where the demand presents particularly high, but the state-by-state regulation set the pace of the market widening. According to the CEO. "...ability to follow up with the evolution of regulation is a competitive advantage; eventually the share of regulated markets will go up and that will make the case for (further and continuous) shift to on-line”. |

Financial Overviews

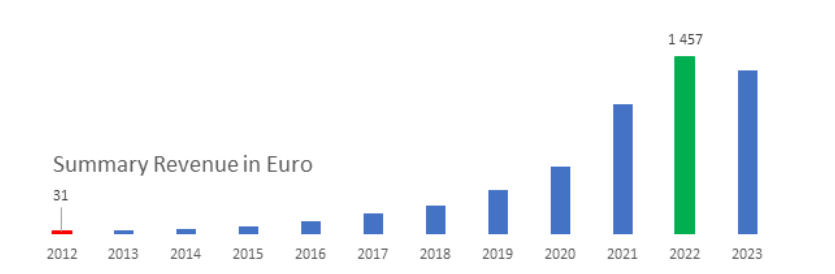

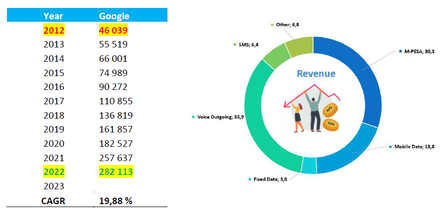

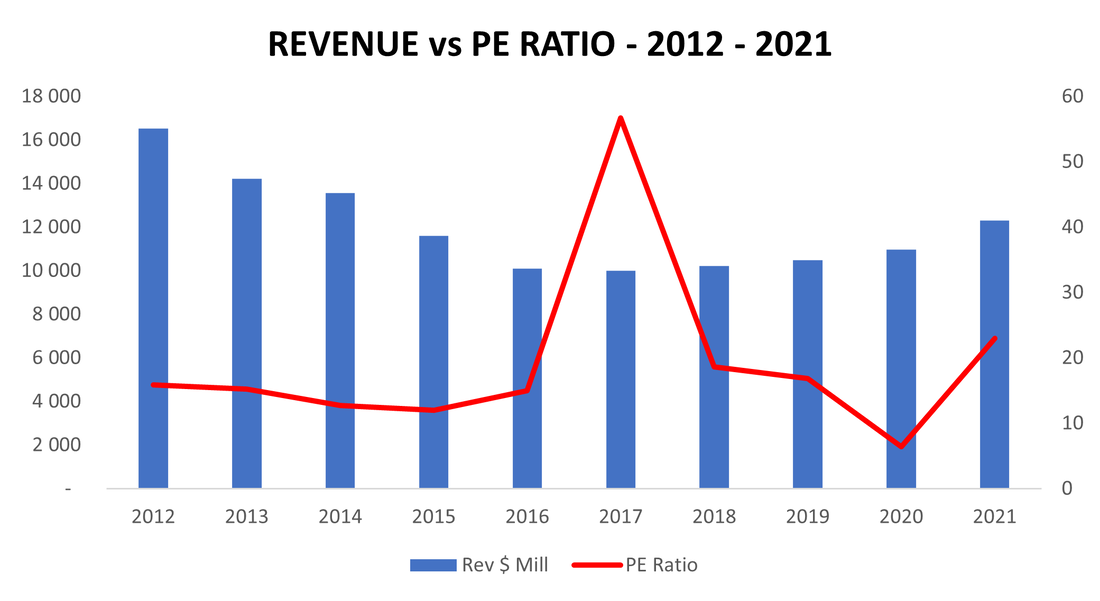

EVO is a highly profitable business in the framework of rapidly rising demand. Organic growth and expansion through strategic acquisitions represent an extraordinary mix: revenue grew at a 40% compounded rate over the last 12 years.

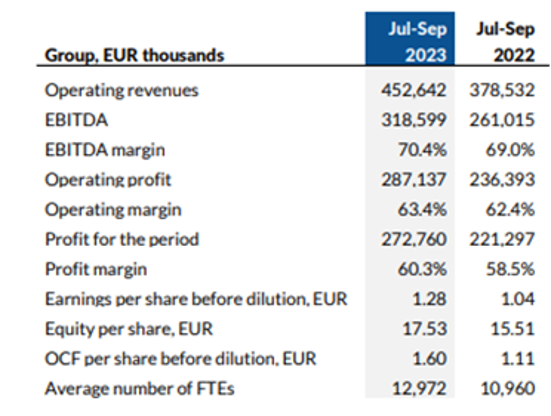

| The Company successfully managed to extraordinarily expand the margins while growing rapidly. That occurred mostly thanks to the benefits of scale. Management set a very ambitious 70% EBITDA margin for 2022 despite the existing inflation pressures. My understanding is that margins are sustainable considering the limited competition and the efficiency gained by scaling up. |

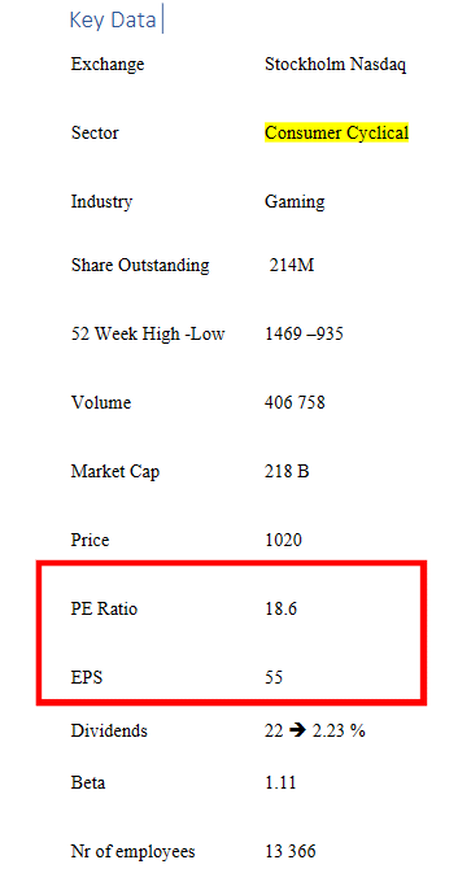

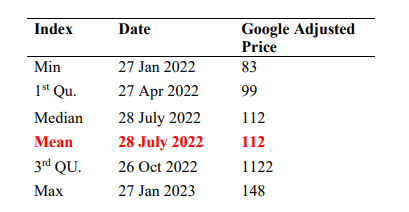

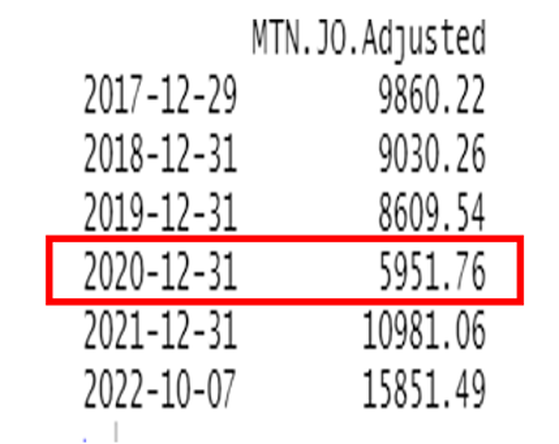

Key Data

Evolution 1000 trading days - stock price fluctuations

Valuation

Evolution is an attractive long because it is the dominant provider of live casino content for online gaming operators globally with a wide moat and a multi-decadal secular growth runway ahead as online gaming grows to become a larger portion of the global gaming TAM, yet is trading near an all-time-low P/E valuation after a recent sell-off.

Revenue sources

Live casinos are roughly 30% penetrated online gaming, so is 4-5% penetrated into the overall global GGR TAM today. Live casino is an immersive player experience that enables play and interaction with real dealers on

Evolution is widely recognized as the best B2B provider of live casino games and dominates with 75-80% market share by revenue globally, supplying B2C operators such as Flutter / Draftkings / etc. with live casino content for players to play on their Ibsites. From a high level, I believe Evolution is a very high-quality business. EVO grows topline 20%+, has 70% EBITDA margins and 50% FCF margins, 100%+ tangible ROICs / 30%+ ROICs including intangibles, revenue is nearly 100% usage-based / recurring.

When I first looked at Evolution, I initially struggled to understand what if anything that EVO does is difficult to replicate.

Revenue sources

- 85% of Evolution's revenue is generated from live casino and is the focus of the investment case.

- 15% of revenue that is generated from RNG slots does not grow nor move the needle.

- Online gaming (includes

- live casino,

- RNG slot games,

- digital poker, etc.)

Live casinos are roughly 30% penetrated online gaming, so is 4-5% penetrated into the overall global GGR TAM today. Live casino is an immersive player experience that enables play and interaction with real dealers on

- blackjack,

- roulette,

- craps games, etc., live,

Evolution is widely recognized as the best B2B provider of live casino games and dominates with 75-80% market share by revenue globally, supplying B2C operators such as Flutter / Draftkings / etc. with live casino content for players to play on their Ibsites. From a high level, I believe Evolution is a very high-quality business. EVO grows topline 20%+, has 70% EBITDA margins and 50% FCF margins, 100%+ tangible ROICs / 30%+ ROICs including intangibles, revenue is nearly 100% usage-based / recurring.

When I first looked at Evolution, I initially struggled to understand what if anything that EVO does is difficult to replicate.

- EVO’s significant scale (4-10x+ larger than their nearest competitors enabling significantly higher R&D spending on game creation and tech development) creates a flywheel effect of product innovation that is difficult for competitors to match (EVO is releasing 100+ games in 2023 vs. its nearest competitor Playtech 20-25; new game releases drive player activity). Because EVO has so many resources, it can test and perfect its games more than anyone else, which enables the Company to have the best and most entertaining games that generate the highest player volumes and in turn the most revenue for operator customers. This is best evidenced by the average revenue generated per game of EVO vs. peers; talking directly to peers Playtech and Pragmatic Play, they admit EVO generates 2-3x or more revenue per game on a like-for-like basis on average (there isn't one thing I can point to for why; it's a combination of 50+ "small details" that all add up to a better game and player experience; I recommend talking to formers to understand this point).

- The unit economics of the industry supports a winner-take-most structure, which reduces the risk of competitive encroachment. EVO typically charges operator customers a 10-15% take rate on GGR; a competitor looking to gain share can come in and offer a 50% discount, or a 7.5% take rate (or more if they wanted), but unless that competitor's games can generate at least 85% of the revenue per game that EVO can generate, the operator would make less money, so is instead incentivized to stay with Evolution despite the higher take rate (e.g. the math is if EVO can generate $100 of GGR on a game less 15% EVO take rate = $85 of net gaming revenue to the operator, since competitors can only generate the equivalent of $33-50 of revenue per game on average across their portfolio relative to EVO due to the inferiority of their games, the operator would make only $31-46 of NGR by favoring a competitor's game placement over EVO's, not even close to what EVO can bring in). Competitive advantage point 1 makes it hard for competitors to generate enough revenue per game to overcome competitive advantage point 2, hence the reinforcing effect which I find attractive.

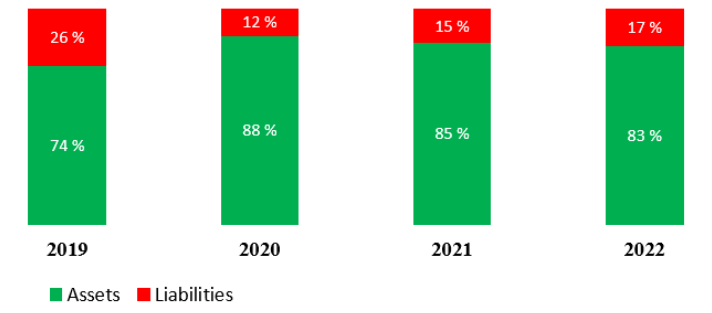

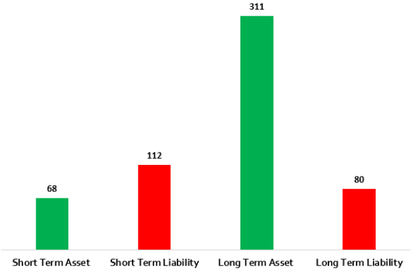

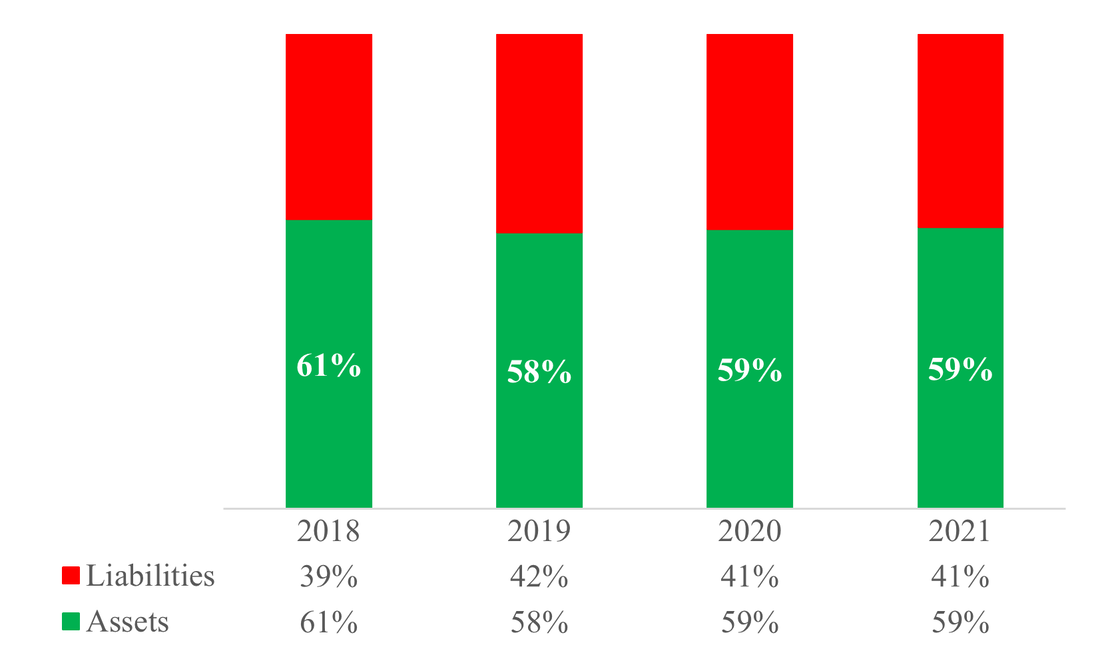

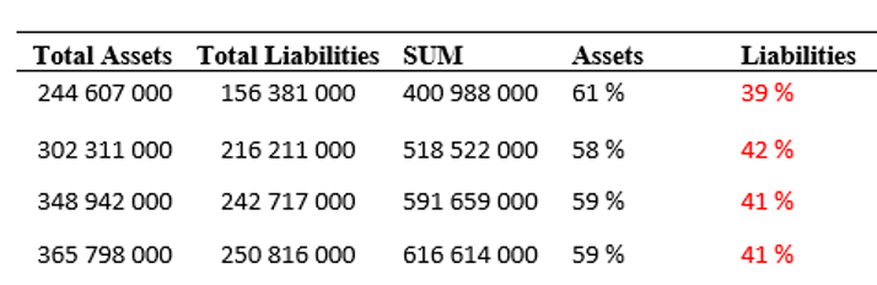

Asset and Liabilities

Management

EVO's management are excellent operators and have a strong track record of success. Martin Carlesund (CEO) is a workhorse and drives the organization forward at a fast pace of innovation. Todd Haushalter (Chief Product Officer) is widely recognized in the gaming industry as one of, if not the most brilliant minds in game design. He is the creative engine at Evolution and is a huge asset. I like that there is significant insider ownership (è17% of the company) that aligns management and the board with shareholders.

The main knock-on EVO is its revenue diversification strategy into RNG slots (purchased NetEnt and several other small RNG studios over the last several years). So far the RNG strategy has not worked as this revenue stream is roughly flattish as EVO is having to re-architect the NetEnt platform and invest more in game development, not to mention the RNG category is significantly more fragmented with significantly loIr barriers to entry and loIr take rates. I view RNG as a call option that if it can grow, great, but if not it isn't significant at only 15% of revenue and doesn't really matter for the investment case.

The main knock-on EVO is its revenue diversification strategy into RNG slots (purchased NetEnt and several other small RNG studios over the last several years). So far the RNG strategy has not worked as this revenue stream is roughly flattish as EVO is having to re-architect the NetEnt platform and invest more in game development, not to mention the RNG category is significantly more fragmented with significantly loIr barriers to entry and loIr take rates. I view RNG as a call option that if it can grow, great, but if not it isn't significant at only 15% of revenue and doesn't really matter for the investment case.

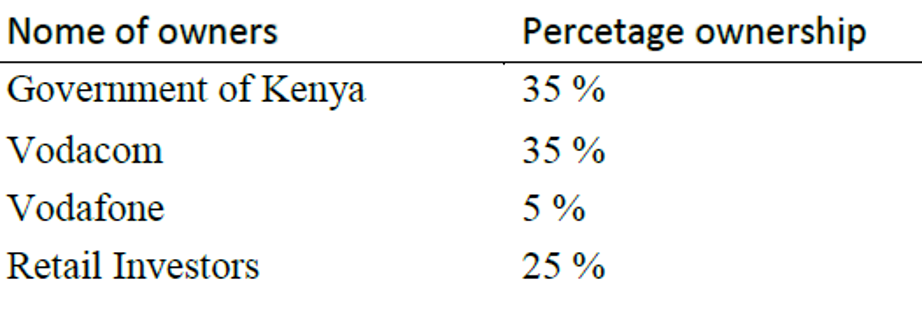

Shareholders

The founders (Jens von Bahr and Fredrik Österberg) retain a joint 10.7% stake in the Company and are board members. Richard Livingstone retains a 4.7% stake and is represented by a board member (close relative). Other board members highlight exposure to the business through equity stakes.

Management is experienced, with sizeable skin on the game and attractive economic incentives through granted options. The 3 key people are:

Management is experienced, with sizeable skin on the game and attractive economic incentives through granted options. The 3 key people are:

- The CEO Martin Carlesund, aged 52, retains 440k shares (worth SEK413m/EUR39m) and additional rights through 1,650k warrants.

- The Chief Product Officer Todd Haushalter, aged 41, retains 83k shares (worth SEK78m/EUR7m) and additional rights through 250k warrants. He joined the Company in 2015 bringing a long land-based casino experience.

- The Chief Strategy Officer Sebastian Johannisson, aged 41, has been with the Company since 2008 and retaining 892k shares (worth SEK838m/EUR80m) and additional rights through 250k warrants.

Management strategy appears very clear:

- to continue organic growth in new markets leveraging on the existing proven platform and the leadership in terms of overall offering and

- to pursue strategic acquisitions aimed at enriching the products' portfolio. My understanding is that the management is appropriately focused on the long-term success of the business (the CEO always refers to a 10-year perspective for growth and does not invite you to focus on quarterly projections/launching of new studios). According to the CEO:

Risks to consider

Regulatory

This is the most debated topic on EVO a differential view that makes comfortable with the position. 40% of EVO's revenue comes from "regulated" markets where online gaming is explicitly legalized and overseen by regulators. 60% of EVO's revenue comes from "unregulated" markets where online gaming is not overseen by regulators and there are no laws in place stipulating whether online gaming is explicitly legal or illegal. EVO does not generate revenue from geographies that are "black markets" where there are laws in place that explicitly ban online gaming (e.g. Australia, or New York State) or are U.N. sactioned countries (e.g. Iran). The debate in the stock lies in investors' opinions around EVO's unregulated exposure.

Bearish investors and some sell side analysts (who in our opinion misunderstand this topic) take the view that unregulated exposure = bad and is a big risk for EVO's business; the risk being I could wake up one day and all of a sudden a piece of EVO's business could be gone because the unregulated market revenue Int away. HoIver, I believe this view fundamentally misunderstands what unregulated revenue even means and I encourage investors to do their own diligence and speak to formers, competitors, and regulators to better understand this key dynamic. Unregulated means there are no laws in place stipulating whether the activity can take place or not. There are many parallels to other industries with similar dynamics. Take Uber for example. In some geographies like NYC, Uber is regulated where drivers must have a specific license to operate in the geography. In many other geographies, Uber is unregulated, meaning they can operate how they choose without stipulations from regulators. Many countries have laws in place that make land-based casino gaming illegal but do not cover online gaming, which enables online activity to take place, and this has been the case for years.

The risk with unregulated markets is that they can change – regulators in a geo can decide to legalize online gaming to collect tax revenue and monitor activity, which can cause temporary disruption to GGR while the regulatory process is sorted out, or they can decide to explicitly ban online gaming and make that geo black and the activity cease. HoIver, an analysis of unregulated countries over the last two decades shows the trend is overwhelmingly toward unregulated markets either staying unregulated or turning to legalized regulated markets (there are only a few isolated occurances of markets turning black; Australia being one, the U.S. being another in the mid-2000s before turning white on a state by state basis beginning in 2013 with NJ). EVO's business in Asia is the biggest question mark for investors, as nearly all countries in the region are unregulated markets. HoIver, when you drill down, this revenue is generated from a wide swath of countries from within the region with no material concentration. This is an important point that I think investors miss – how geographically diversified EVO is with no country making up more than ~5% of revenue (besides the U.S. but the U.S. is regulated state by state, so that limits exposure further). This means even if one or a few countries Ire to come out with unfavorable regulatory changes to turn white or black all at once in one year, EVO has enough other geographies growing independently that they can sustain overall growth (e.g. Germany turned from unregulated to regulated in 2021 and in the process of required operators to exit the market for a period of time. Germany was 7% of EVO's revenue and fell by 50% during this process. Despite this revenue hit, it was barely noticeable in the financials as EVO continued growing in other geos). I think the trend of unregulated markets likely staying unregulated or moving to regulated coupled with EVO's wide geographical diversity limits the regulatory risk the Company faces.

Mobile Sports Betting and iGaming Footprint

This is the most debated topic on EVO a differential view that makes comfortable with the position. 40% of EVO's revenue comes from "regulated" markets where online gaming is explicitly legalized and overseen by regulators. 60% of EVO's revenue comes from "unregulated" markets where online gaming is not overseen by regulators and there are no laws in place stipulating whether online gaming is explicitly legal or illegal. EVO does not generate revenue from geographies that are "black markets" where there are laws in place that explicitly ban online gaming (e.g. Australia, or New York State) or are U.N. sactioned countries (e.g. Iran). The debate in the stock lies in investors' opinions around EVO's unregulated exposure.

Bearish investors and some sell side analysts (who in our opinion misunderstand this topic) take the view that unregulated exposure = bad and is a big risk for EVO's business; the risk being I could wake up one day and all of a sudden a piece of EVO's business could be gone because the unregulated market revenue Int away. HoIver, I believe this view fundamentally misunderstands what unregulated revenue even means and I encourage investors to do their own diligence and speak to formers, competitors, and regulators to better understand this key dynamic. Unregulated means there are no laws in place stipulating whether the activity can take place or not. There are many parallels to other industries with similar dynamics. Take Uber for example. In some geographies like NYC, Uber is regulated where drivers must have a specific license to operate in the geography. In many other geographies, Uber is unregulated, meaning they can operate how they choose without stipulations from regulators. Many countries have laws in place that make land-based casino gaming illegal but do not cover online gaming, which enables online activity to take place, and this has been the case for years.

The risk with unregulated markets is that they can change – regulators in a geo can decide to legalize online gaming to collect tax revenue and monitor activity, which can cause temporary disruption to GGR while the regulatory process is sorted out, or they can decide to explicitly ban online gaming and make that geo black and the activity cease. HoIver, an analysis of unregulated countries over the last two decades shows the trend is overwhelmingly toward unregulated markets either staying unregulated or turning to legalized regulated markets (there are only a few isolated occurances of markets turning black; Australia being one, the U.S. being another in the mid-2000s before turning white on a state by state basis beginning in 2013 with NJ). EVO's business in Asia is the biggest question mark for investors, as nearly all countries in the region are unregulated markets. HoIver, when you drill down, this revenue is generated from a wide swath of countries from within the region with no material concentration. This is an important point that I think investors miss – how geographically diversified EVO is with no country making up more than ~5% of revenue (besides the U.S. but the U.S. is regulated state by state, so that limits exposure further). This means even if one or a few countries Ire to come out with unfavorable regulatory changes to turn white or black all at once in one year, EVO has enough other geographies growing independently that they can sustain overall growth (e.g. Germany turned from unregulated to regulated in 2021 and in the process of required operators to exit the market for a period of time. Germany was 7% of EVO's revenue and fell by 50% during this process. Despite this revenue hit, it was barely noticeable in the financials as EVO continued growing in other geos). I think the trend of unregulated markets likely staying unregulated or moving to regulated coupled with EVO's wide geographical diversity limits the regulatory risk the Company faces.

Mobile Sports Betting and iGaming Footprint

- DraftKings is live with mobile sports betting in 21 states that collectively represent approximately 44% of the U.S. population.

- DraftKings is also live with iGaming in 5 states, representing approximately 11% of the U.S. population.

- DraftKings is live with its Sportsbook and iGaming products in Ontario, Canada, which represents approximately 40% of Canada’s population.

- Kentucky, North Carolina, Vermont, and Puerto Rico have authorized mobile sports betting and collectively represent approximately 6% of the U.S. population. DraftKings expects to launch its Sportsbook product in Kentucky on September 28, 2023, as well as in North Carolina, Vermont, and Puerto Rico, in each case pending licensure and regulatory approvals as well as securing market access in North Carolina and Vermont.

- In 2023, 12 states that collectively represent approximately 24% of the U.S. population have either introduced legislation to legalize mobile sports betting or introduced bills that may result in sports wagering referendums during an upcoming election. In addition, 5 states that collectively represent approximately 14% of the U.S. population have either introduced legislation to legalize iGaming or introduced a bill that may result in an iGaming referendum during an upcoming election.

Competition.

Competitors have been trying to knock down EVO for years and many have failed while market share of the #2 and #3 players has been relatively stagnant. NetEnt tried standing up a live casino product for 7 years and finally shut it down in 2020 after not gaining any traction. Playtech has ~15% market share by revenue folloId by Pragmatic Play with ~5% market share by revenue. These two are legitimate competitors but they largely copy EVO's games and lack quality innovation of their own to displace EVO in any material way.

On Air Entertainment and a handful of other new entrants within the last 6-24 months are in various stages of building out studios in Europe and LatAm to try to break into the industry, but so far the market share of each of these players is <1% and I believe it will be difficult for them to scale outside of fringe tier 2 and tier 3 operators due to the competitive advantages of EVO I discussed.

There are also several B2C operators who are attempting to build out live casino products of their own, some for in-house use, and some for B2B white label use. That said, I believe the in-house use case will be isolated and not impactful (it's just hard for an operator to invest enough R&D to develop a competitive enough game that will only be used for their own Ibsite, whereas EVO and other third party competitors can amortize their R&D across all of their customers; the risk for an operator is if they favor their own in-house games or loIr-quality competitors' games that players don't like, those players will leave and go to other operators' Ibsites that have EVO's games), while I understand the B2B white label use case is going to be developed and rolled out slowly and incrementally (after already failing twice; this is the third try), so I do not expect any material impact to EVO from B2C operators trying to insource.

On Air Entertainment and a handful of other new entrants within the last 6-24 months are in various stages of building out studios in Europe and LatAm to try to break into the industry, but so far the market share of each of these players is <1% and I believe it will be difficult for them to scale outside of fringe tier 2 and tier 3 operators due to the competitive advantages of EVO I discussed.

There are also several B2C operators who are attempting to build out live casino products of their own, some for in-house use, and some for B2B white label use. That said, I believe the in-house use case will be isolated and not impactful (it's just hard for an operator to invest enough R&D to develop a competitive enough game that will only be used for their own Ibsite, whereas EVO and other third party competitors can amortize their R&D across all of their customers; the risk for an operator is if they favor their own in-house games or loIr-quality competitors' games that players don't like, those players will leave and go to other operators' Ibsites that have EVO's games), while I understand the B2B white label use case is going to be developed and rolled out slowly and incrementally (after already failing twice; this is the third try), so I do not expect any material impact to EVO from B2C operators trying to insource.

Business

The Estée Lauder Companies Inc., founded in 1946 by Estée and Joseph Lauder, is one of the world’s leading manufacturers, marketers, and sellers of

- Quality skin care,

- Makeup,

- Fragrance and

- Hair care products.

- Their own and authorized retailer theybsites,

- On third-party online malls, in stores in

- Airports,

- In duty-free locations and in our own authorized freestanding stores.

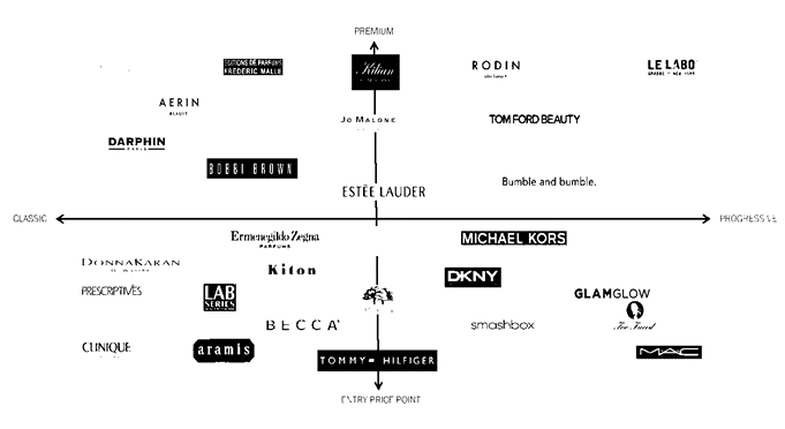

Estee Lauder Brands

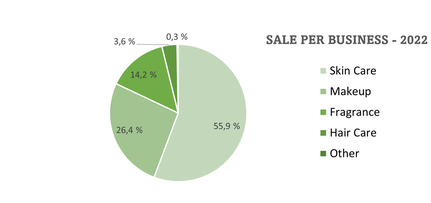

Skin Care - products address various skin care needs. These products include moisturizers, serums, cleansers, toners, body care, exfoliators, acne care and oil correctors, facial masks, and sun care products.

Makeup - Their full array of makeup products includes lipsticks, lip glosses, mascaras, foundations, eyeshadows, nail polishes and powders. Many of the products are offered in an extensive palette of shades and colors. They also sell related items such as compacts, brushes, and other makeup tools.

Fragrance - They offer a variety of fragrance products. The fragrances are sold in various forms, including eau de parfum sprays and colognes, as theyll as lotions, powders, creams, candles, and soaps that are based on a particular fragrance.

Hair Care - Their hair care products include shampoos, conditioners, styling products, treatment, finishing sprays and hair color products.

Other - They also sell ancillary products and services.

Makeup - Their full array of makeup products includes lipsticks, lip glosses, mascaras, foundations, eyeshadows, nail polishes and powders. Many of the products are offered in an extensive palette of shades and colors. They also sell related items such as compacts, brushes, and other makeup tools.

Fragrance - They offer a variety of fragrance products. The fragrances are sold in various forms, including eau de parfum sprays and colognes, as theyll as lotions, powders, creams, candles, and soaps that are based on a particular fragrance.

Hair Care - Their hair care products include shampoos, conditioners, styling products, treatment, finishing sprays and hair color products.

Other - They also sell ancillary products and services.

Manufacturing, Warehousing and Raw MaterialsThe company manufactures its products primarily in its own facilities located in the

To meet the increasing demand and expedite market access in the Asia/Pacific region, they began constructing a new manufacturing facility near Tokyo in fiscal 2021. The first phase of construction was completed in fiscal 2022, with the remaining site expected to be operational by early fiscal 2024. While they believe their current manufacturing network is sufficient, they strive to enhance capacity, technology, and productivity to align with regional sales demand. They have a flexible global distribution network managed by themselves or third-party logistic providers.

This network is designed to adapt to changing customer demands while maintaining service levels. They continuously evaluate and adjust their physical distribution network, especially to anticipate and respond to shifts in distribution channels. They have strategically positioned regional and local distribution centers worldwide, including those operated by third parties, to ensure efficient product delivery to customers and consumers. In fiscal 2022, they opened a state-of-the-art distribution center in Switzerland to support the growth of their travel retail business and promote sustainability initiatives. They are confident that their manufacturing and distribution capabilities can meet annual and long-term strategic objectives, although short-term fluctuations in demand may temporarily challenge capacity for specific product subcategories.

- United States,

- Belgium,

- Switzerland,

- the United Kingdom, and Canada.

To meet the increasing demand and expedite market access in the Asia/Pacific region, they began constructing a new manufacturing facility near Tokyo in fiscal 2021. The first phase of construction was completed in fiscal 2022, with the remaining site expected to be operational by early fiscal 2024. While they believe their current manufacturing network is sufficient, they strive to enhance capacity, technology, and productivity to align with regional sales demand. They have a flexible global distribution network managed by themselves or third-party logistic providers.

This network is designed to adapt to changing customer demands while maintaining service levels. They continuously evaluate and adjust their physical distribution network, especially to anticipate and respond to shifts in distribution channels. They have strategically positioned regional and local distribution centers worldwide, including those operated by third parties, to ensure efficient product delivery to customers and consumers. In fiscal 2022, they opened a state-of-the-art distribution center in Switzerland to support the growth of their travel retail business and promote sustainability initiatives. They are confident that their manufacturing and distribution capabilities can meet annual and long-term strategic objectives, although short-term fluctuations in demand may temporarily challenge capacity for specific product subcategories.

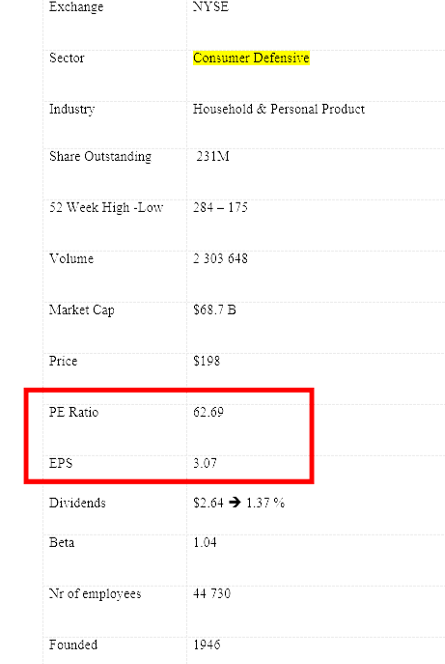

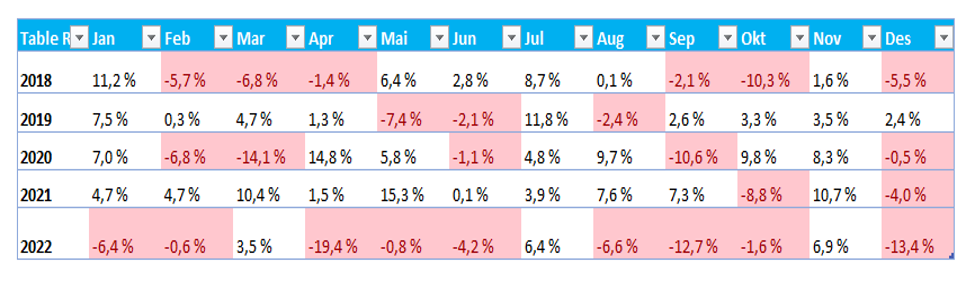

Key Data

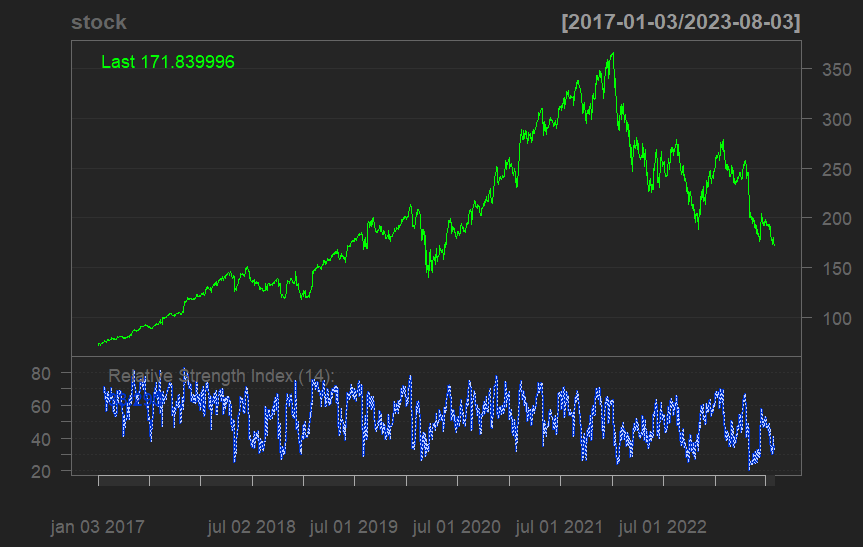

THE ESTÉE LAUDER COMPANIES INC Technnical Analysis

Historical daily share price chart and data for the Estee Lauder since 2019 adjusted for splits. The latest closing stock price for Estee Lauder as of August 04, 2023, is $172.

- The all-time high Estee Lauder's stock closing price was $370 on December 01, 2021.

- Estee Lauder's five years median stock price is $202.8 October 2020, which is 18% above the current share price.

- The Estee Lauder's 5 years third quantile stock price is $260 in February 2022, which is 51 % above the current share price.

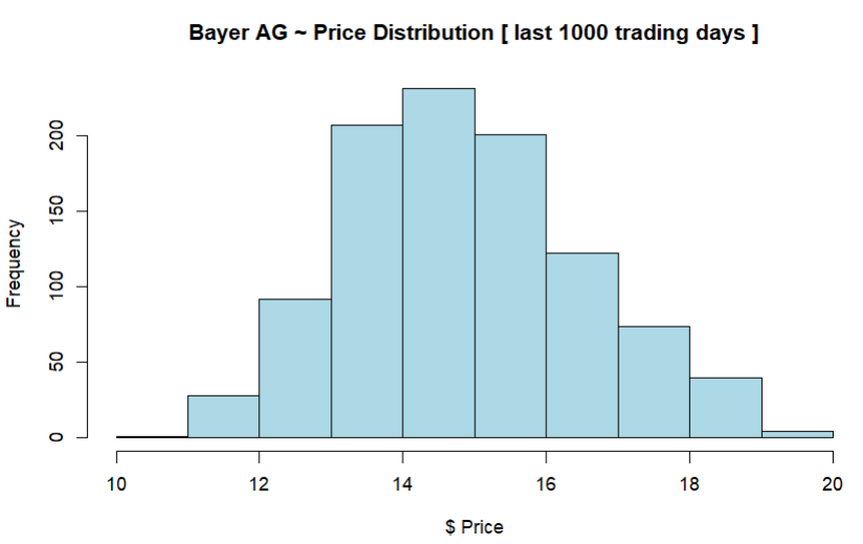

Estee Lauder's 1000 trading days stock distribution

The following tables provide a summary of

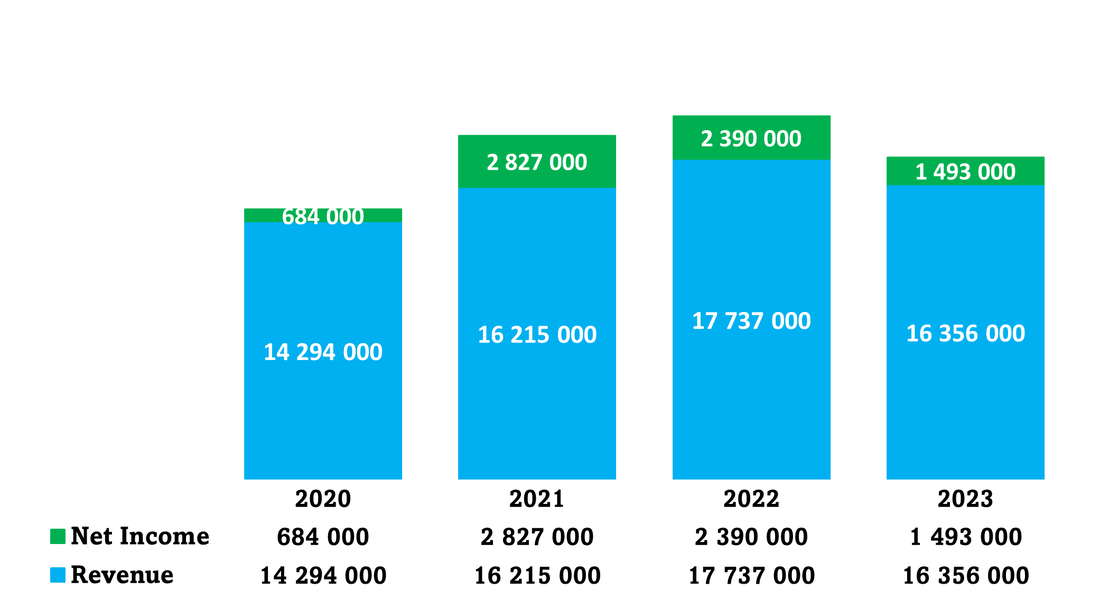

The Esêe Lauder Company. Income Statements

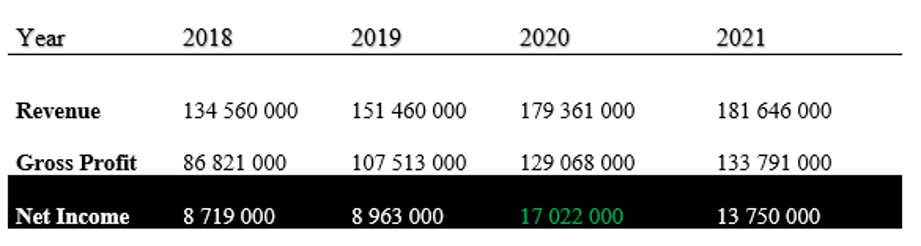

The Estée Lauder income statement represents the revenue for a business over the last four periods. Here's how the revenue changes over the four periods. Based on this data, we can observe a generally increasing trend in revenue from year 2020 to 2022, with a slight decrease in year 2023. It indicates that the business experienced growth in its revenue initially, followed by a slight decline.

SALES

Competition

The company faces significant competition in the markets where it sells its skin care, makeup, fragrance, and hair care products. Consumers consider various factors such as brand recognition, product quality, accessibility, distribution channels, and price when choosing among competing products. Marketing strategies, in-store and online experiences, product demonstrations, and new innovations also influence consumers' purchasing decisions. The company acknowledges the growing interest in responsibly sourced and environmentally sustainable products, which aligns with their social impact and sustainability efforts, providing a competitive advantage.

The company competes with both global and local companies, including major multinational manufacturers and marketers such as

- L’Oréal,

- Unilever,

- Procter & Gamble, Shiseido,

- LVMH, Natura & Co., Chanel,

- Beiersdorf, Coty, Kao Corp, and LG Household & Health Care.

Performance

The quarterly data shows a mix of positive and negative growth rates. There are quarters with significant positive growth, such as Jun. 19 (23.5%), Sep. 19 (20.1%), and Mar. 21 (33.0%). However, there are also quarters with significant negative growth, such as Jun. 20 (-13.6%), Mar. 22 (-37.3%), and Jun. 22 (-46.0%). Overall, the data indicates fluctuations in growth over the specified period, with both periods of expansion and contraction.

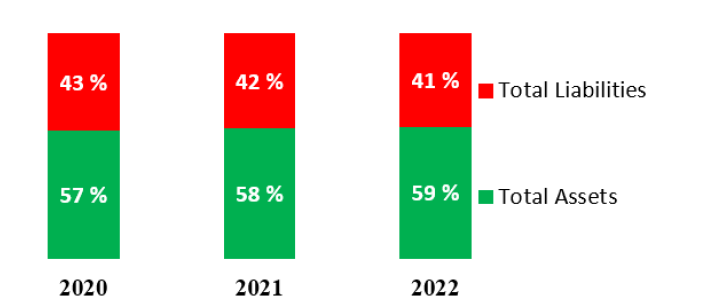

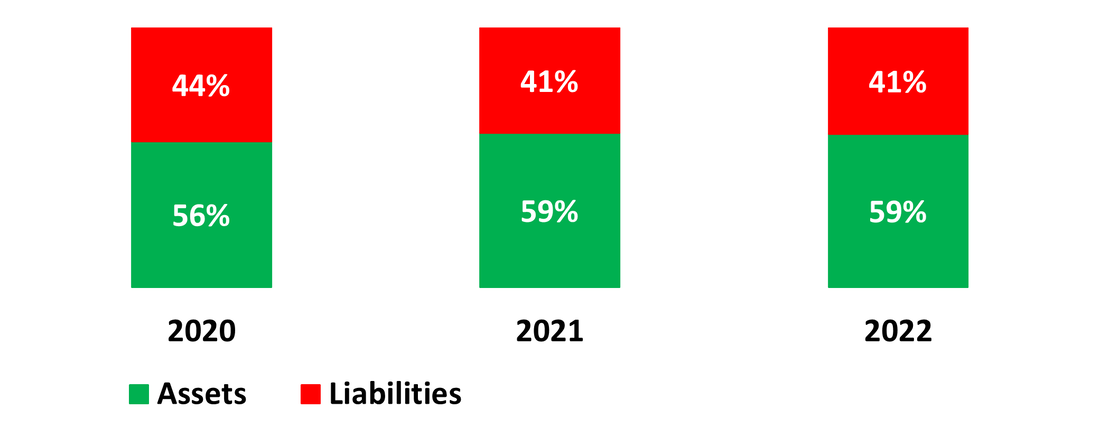

Financial Health of Estee Lauder

In summary, the company's total assets, total liabilities, and equity/net worth have changed over the three years. It is important we note that this data alone does not provide enough information to draw definitive conclusions about the financial health or performance of the company. Additional financial statements, such as income statements and cash flow statements, would be necessary for a more comprehensive analysis.

These trends indicate fluctuations in Estee Lauder assets and liabilities over the three-year period. However, we prefer to see assets are greater than liabilities.

These trends indicate fluctuations in Estee Lauder assets and liabilities over the three-year period. However, we prefer to see assets are greater than liabilities.

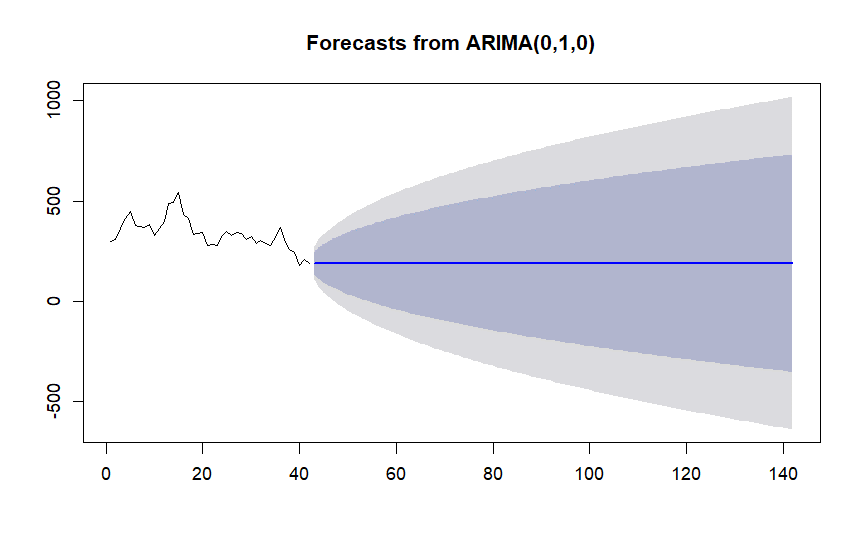

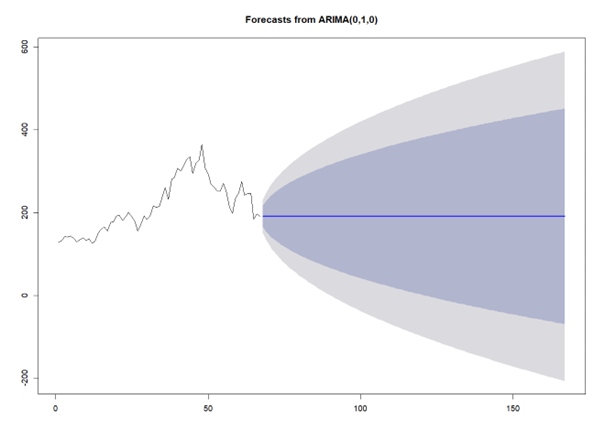

Estee Lauder Price forecast

Business

McDonald’s Corporation (MCD) is a Global foodservice retailer that operated and franchised a total of 40,275 restaurants worldwide in 2022, up from 40,031 restaurants in 2021. The company has seen a year-over-year increase in restaurants for the last 17. Market-share leading quick service restaurant (QSR) with over 40 000 restaurants, $88bn systemwide sales, and $23bn revenue globally.

- Dominant player in largest QSR sub-category: burgers

- Geographically diversified – in terms sales:

- 48 % International

- 41 % U.S.A.

- 12 % Others.

- Brand royalty = 4% of sales

- Rent = 9% of sales (in cases where MCD owns the underlying real estate)

- Royalties and rent contribute to 75% of total EBITDA.

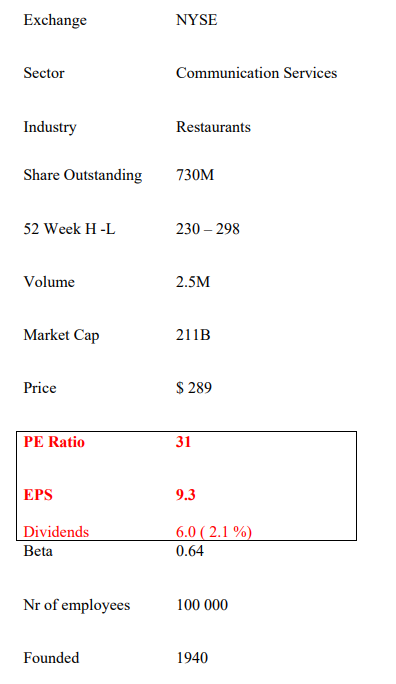

Key Data

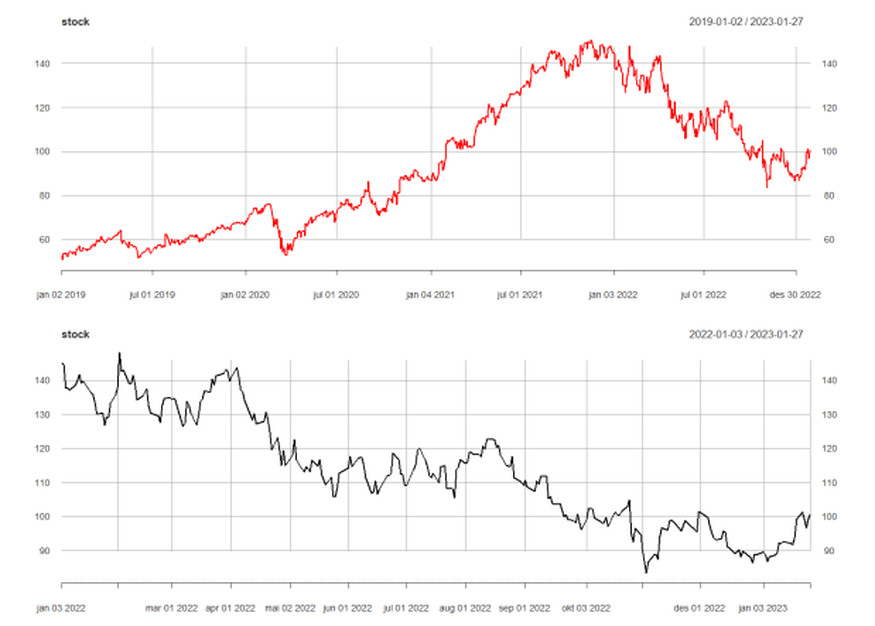

McDonald's Technnical Analysis

Historical daily share price chart and data for McDonald's since 2019 adjusted for splits. The latest closing stock price for McDonalds as of July 05, 2023, is $295.

- The all-time high McDonald's stock closing price was $298 on April 01, 2023.

- McDonald's 5 years median stock price is $200 in October 2020, which is 32.2% below the current share price.

- McDonald's 5 years third quantile stock price is $240 in February 2023, which is 18.6% below the current share price.

- The 5 years average McDonald's stock price is $204.9. We can see the red line in the following chart.

McDonald's 1000 trading days stock distribution

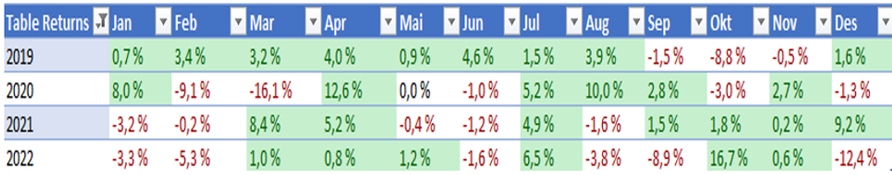

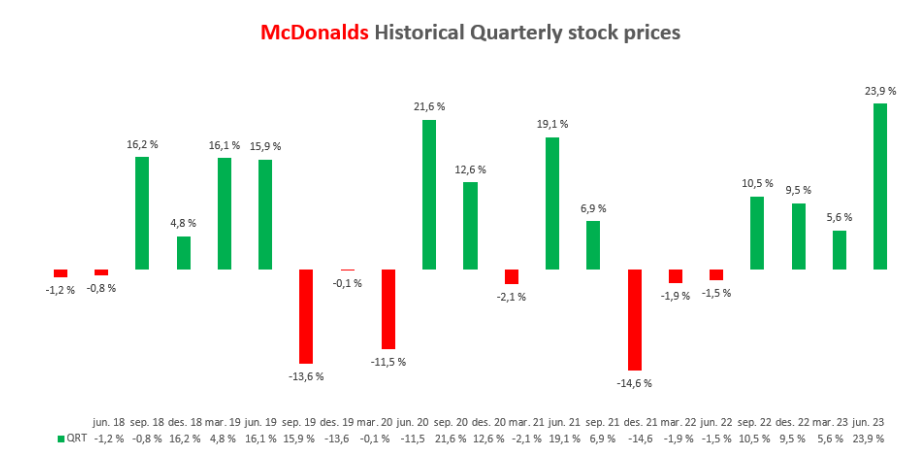

Valuation – Performance

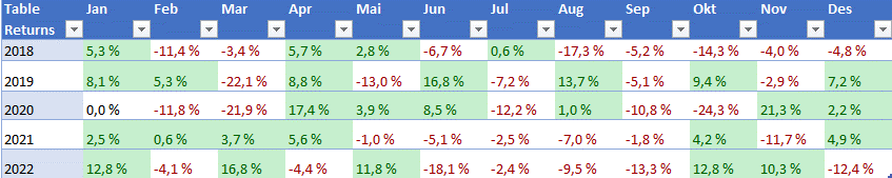

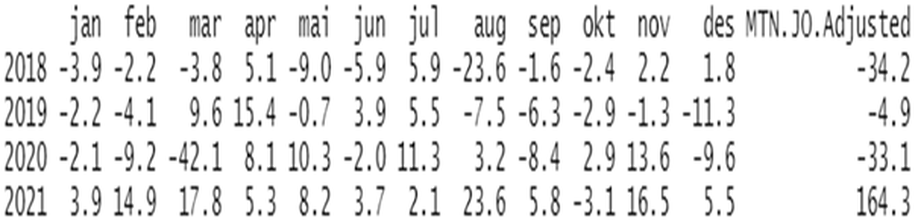

Breaking down and examining the percentage changes for each month for the year 2022. Volatility, the stock price of McDonald's appears to have experienced significant volatility throughout the year. Large positive and negative percentage changes indicate substantial fluctuations in market sentiment and investor perceptions. Overall Performance, while there are periods of positive performance, such as March, April, May, July, and October, there are also significant declines in other months, such as February, June, August, September, November, and December, and improved in last six months.

How does McDonalds Make money ?McDonald’s franchised restaurants are owned and operated under one of the following.

The Company is primarily a franchisor and believes franchising is paramount to

- Structures - conventional franchise,

- Developmental license or affiliate.

The Company is primarily a franchisor and believes franchising is paramount to

- Delivering great-tasting food,

- Locally relevant customer experiences and

- Driving profitability.

Franchising enables an individual to be their own employer and maintain control over all employment related matters, marketing, and pricing decisions, while also benefiting from the strength of McDonald’s global brand, operating system and financial resources.

Directly operating McDonald’s restaurants contributes significantly to the Company's ability to act as a credible franchisor. One of the strengths of the franchising model is that the expertise from operating Company-owned restaurants allows McDonald’s to improve the operations and success of all restaurants while innovations from franchisees can be tested and, when viable, efficiently implemented across relevant restaurants. Having Company-owned and operated restaurants provides Company personnel with a venue for restaurant operations training experience. In addition, in our Company-owned and operated restaurants, and in collaboration with franchisees, the Company is able to further develop and refine operating standards, marketing concepts and product and pricing strategies that will ultimately benefit McDonald’s restaurants.

The Company’s revenues consist of sales by Company-operated restaurants and fees from restaurants operated by franchisees. Fees vary by type of site, amount of Company investment, if any, and local business conditions. These fees, along with occupancy and operating rights, are stipulated in franchise/license agreements that generally have 20-year terms. The Company’s Other revenues are comprised of fees paid by franchisees to recover a portion of costs incurred by the Company for various technology platforms, revenues from brand licensing arrangements to market and sell consumer packaged goods using the McDonald’s brand and, for periods prior to its sale on April 1, 2022, third-party revenues for the Company's Dynamic Yield business.

Conventional Franchise

Under a conventional franchise arrangement, the Company generally owns or secures a long-term lease on the land and building for the restaurant location and the franchisee pays for equipment, signs, seating and décor. The Company believes that ownership of real estate, combined with the co-investment by franchisees, enables it to achieve restaurant performance levels that are among the highest in the industry.

Franchisees are responsible for reinvesting capital in their businesses over time. In addition, to accelerate implementation of certain initiatives, the Company may co-invest with franchisees to fund improvements to their restaurants or operating systems. These investments, developed in collaboration with franchisees, are designed to cater to consumer preferences, improve local business performance and increase the value of the McDonald's brand through the development of modernized, more attractive, and higher revenue generating restaurants.

Directly operating McDonald’s restaurants contributes significantly to the Company's ability to act as a credible franchisor. One of the strengths of the franchising model is that the expertise from operating Company-owned restaurants allows McDonald’s to improve the operations and success of all restaurants while innovations from franchisees can be tested and, when viable, efficiently implemented across relevant restaurants. Having Company-owned and operated restaurants provides Company personnel with a venue for restaurant operations training experience. In addition, in our Company-owned and operated restaurants, and in collaboration with franchisees, the Company is able to further develop and refine operating standards, marketing concepts and product and pricing strategies that will ultimately benefit McDonald’s restaurants.

The Company’s revenues consist of sales by Company-operated restaurants and fees from restaurants operated by franchisees. Fees vary by type of site, amount of Company investment, if any, and local business conditions. These fees, along with occupancy and operating rights, are stipulated in franchise/license agreements that generally have 20-year terms. The Company’s Other revenues are comprised of fees paid by franchisees to recover a portion of costs incurred by the Company for various technology platforms, revenues from brand licensing arrangements to market and sell consumer packaged goods using the McDonald’s brand and, for periods prior to its sale on April 1, 2022, third-party revenues for the Company's Dynamic Yield business.

Conventional Franchise

Under a conventional franchise arrangement, the Company generally owns or secures a long-term lease on the land and building for the restaurant location and the franchisee pays for equipment, signs, seating and décor. The Company believes that ownership of real estate, combined with the co-investment by franchisees, enables it to achieve restaurant performance levels that are among the highest in the industry.

Franchisees are responsible for reinvesting capital in their businesses over time. In addition, to accelerate implementation of certain initiatives, the Company may co-invest with franchisees to fund improvements to their restaurants or operating systems. These investments, developed in collaboration with franchisees, are designed to cater to consumer preferences, improve local business performance and increase the value of the McDonald's brand through the development of modernized, more attractive, and higher revenue generating restaurants.

Financial Health

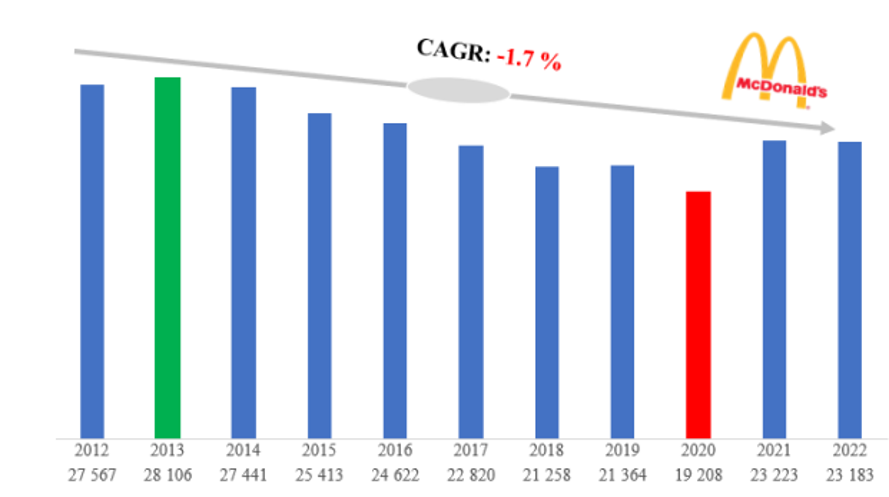

McDonald’s compound annual average growth rate since 2012 is unimpressed of -1.72 %. Continuously present in the international market operations are slowing significant to McDonald’s revenues and net income. International revenues accounted for approximately 61% of their consolidated revenues in 2022.

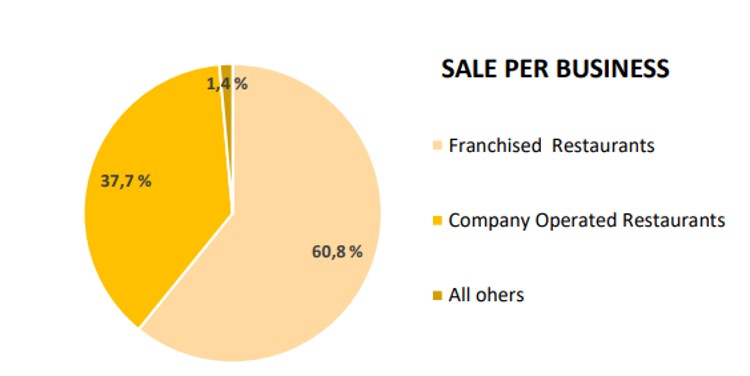

Sources of revenues: Sales per businessMcDonald's Corporation is the world's biggest fast-food chain. Net sales break down by type of restaurants as follows:

- Franchised and affiliated restaurants (60.8%): owned, at the end of 2022, +40 000 franchises (of which 7,775 affiliates).

- Company-operated restaurants (37.7%): 2,736 restaurants.

- Other (1.4%).

- 61.8% of net sales are abroad.

Franchised margins represented nearly 90% of restaurant margin dollars.

Total restaurant margin growth was negatively impacted in both periods by foreign currency translation due to the weakening of all major currencies against the U.S. Dollar. Franchised margins in the U.S. reflected higher depreciation costs related to investments in restaurant modernization. Company-operated margins in the U.S. and International Operated Markets segment reflected positive sales performance driven by strategic menu price increases, and the negative impact of inflationary pressures. Results in the International Operated Markets segment were also negatively impacted by the restaurant closures in Russia and Ukraine. Total restaurant margins included $1,501 million of depreciation and amortization expenses in 2022.

Total restaurant margin growth was negatively impacted in both periods by foreign currency translation due to the weakening of all major currencies against the U.S. Dollar. Franchised margins in the U.S. reflected higher depreciation costs related to investments in restaurant modernization. Company-operated margins in the U.S. and International Operated Markets segment reflected positive sales performance driven by strategic menu price increases, and the negative impact of inflationary pressures. Results in the International Operated Markets segment were also negatively impacted by the restaurant closures in Russia and Ukraine. Total restaurant margins included $1,501 million of depreciation and amortization expenses in 2022.

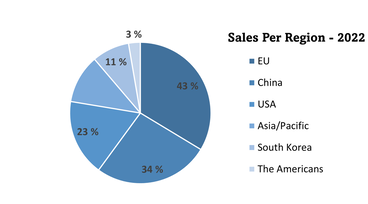

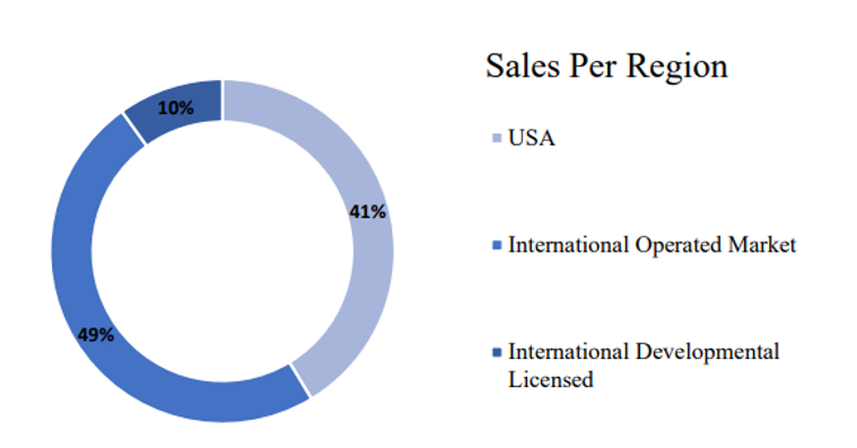

Sales per region

Net sales are distributed geographically as follows: the United States (41%), International operate markets (49%), and international development licensed (10).

As the home country of McDonald's, the United States has traditionally been one of its largest markets. McDonald's has a strong presence across the country, and the U.S. market accounts for a substantial portion of its global sales. In the western area we find that McDonald's has a significant presence in various European countries. Major markets in Europe include the United Kingdom, Germany, France, among others. Europe has been an important region for McDonald's in terms of sales and market share. However, other regions, such as Latin America, the Middle East, and Africa. These regions contribute to McDonald's overall sales, albeit to a lesser extent compared to the previously mentioned regions.

As the home country of McDonald's, the United States has traditionally been one of its largest markets. McDonald's has a strong presence across the country, and the U.S. market accounts for a substantial portion of its global sales. In the western area we find that McDonald's has a significant presence in various European countries. Major markets in Europe include the United Kingdom, Germany, France, among others. Europe has been an important region for McDonald's in terms of sales and market share. However, other regions, such as Latin America, the Middle East, and Africa. These regions contribute to McDonald's overall sales, albeit to a lesser extent compared to the previously mentioned regions.

Competitors

McDonald’s restaurants compete with international, national, regional, and local retailers of traditional, fast casual and other food service competitors. The Company measures its competitive position within the informal eating out ("IEO") segment, which is inclusive of the Company's primary competition of quick-service restaurants, but also includes 100% home delivery/takeaway providers, street stalls or kiosks, cafés, specialist coffee shops, self-service cafeterias, and juice/smoothie bars. The Company competes among quick-service restaurants primarily on the basis of price, convenience, service, experience, menu variety and product quality.

Intense competition

McDonald’s competes primarily in the IEO segment, which is highly competitive. They also face sustained, intense competition from traditional, fast casual and other competitors, which may include many non-traditional market participants such as convenience stores, grocery stores, coffee shops and online retailers. They expect their environment to continue to be highly competitive, and our results in any particular reporting period may be impacted by a contracting IEO segment or by new or continuing actions, product offerings or consolidation of their competitors and third-party partners, which may have a short- or long-term impact on their results. McDonald competes primarily on the basis of product choice, quality, affordability, service, and location.

Fast food industry competitorsMcDonald's faces competition from several companies in the fast-food industry. Here are some of its major competitors:

Burger King: Burger King is a global fast-food chain that offers a similar menu to McDonald's, including burgers, fries, and chicken items. It is known for its flame-grilled burgers and has a strong presence in the United States and other countries.

Wendy's: Wendy's is another prominent fast-food chain that competes with McDonald's. It differentiates itself by offering a "fresh, never frozen" slogan for its beef patties and a menu that includes salads, chicken sandwiches, and Frosty desserts.

Subway: Although Subway is primarily known for its sandwiches, it competes with McDonald's by offering quick-service options. Subway emphasizes its healthier menu choices, including a variety of fresh ingredients and customization options.

KFC: Kentucky Fried Chicken (KFC) is a popular fast-food chain specializing in fried chicken. While its focus is different from McDonald's, it competes in the fast-food industry and has a significant global presence.

Taco Bell: Taco Bell is a fast-food chain known for its Mexican-inspired menu, including tacos, burritos, and quesadillas. While its offerings differ from McDonald's, it competes for customers seeking quick-service dining options.

Chipotle Mexican Grill: Chipotle is a fast-casual chain known for its customizable burritos, bowls, and tacos. While it operates in a slightly different segment, it competes for customers seeking quick and customizable dining options.

In-N-Out Burger: In-N-Out Burger is a regional chain in the western United States. It is known for its fresh, made-to-order burgers and limited menu. Despite its smaller footprint, In-N-Out Burger has a loyal customer base and competes for customers looking for quality fast-food options.

Intense competition

McDonald’s competes primarily in the IEO segment, which is highly competitive. They also face sustained, intense competition from traditional, fast casual and other competitors, which may include many non-traditional market participants such as convenience stores, grocery stores, coffee shops and online retailers. They expect their environment to continue to be highly competitive, and our results in any particular reporting period may be impacted by a contracting IEO segment or by new or continuing actions, product offerings or consolidation of their competitors and third-party partners, which may have a short- or long-term impact on their results. McDonald competes primarily on the basis of product choice, quality, affordability, service, and location.

Fast food industry competitorsMcDonald's faces competition from several companies in the fast-food industry. Here are some of its major competitors:

Burger King: Burger King is a global fast-food chain that offers a similar menu to McDonald's, including burgers, fries, and chicken items. It is known for its flame-grilled burgers and has a strong presence in the United States and other countries.

Wendy's: Wendy's is another prominent fast-food chain that competes with McDonald's. It differentiates itself by offering a "fresh, never frozen" slogan for its beef patties and a menu that includes salads, chicken sandwiches, and Frosty desserts.

Subway: Although Subway is primarily known for its sandwiches, it competes with McDonald's by offering quick-service options. Subway emphasizes its healthier menu choices, including a variety of fresh ingredients and customization options.

KFC: Kentucky Fried Chicken (KFC) is a popular fast-food chain specializing in fried chicken. While its focus is different from McDonald's, it competes in the fast-food industry and has a significant global presence.

Taco Bell: Taco Bell is a fast-food chain known for its Mexican-inspired menu, including tacos, burritos, and quesadillas. While its offerings differ from McDonald's, it competes for customers seeking quick-service dining options.

Chipotle Mexican Grill: Chipotle is a fast-casual chain known for its customizable burritos, bowls, and tacos. While it operates in a slightly different segment, it competes for customers seeking quick and customizable dining options.

In-N-Out Burger: In-N-Out Burger is a regional chain in the western United States. It is known for its fresh, made-to-order burgers and limited menu. Despite its smaller footprint, In-N-Out Burger has a loyal customer base and competes for customers looking for quality fast-food options.

SWOT ANALYSIS

McDonald’s strengthOne of the strengths of the franchising model is that the expertise from operating Company-owned restaurants allows McDonald’s to improve the operations and success of all restaurants while innovations from franchisees can be tested and, when viable, efficiently implemented across relevant restaurants. Having Company-owned and operated restaurants provides Company personnel with a venue for restaurant operations training experience. In addition, in our Company-owned and operated restaurants, and in collaboration with franchisees, the Company is able to further develop and refine operating standards, marketing concepts and product and pricing strategies that will ultimately benefit McDonald’s restaurants.

Global presence: McDonald's is one of the world's largest fast-food chains, with a presence in over 100 countries. Its widespread network of restaurants gives it a significant advantage over competitors.

Brand recognition: McDonald's is a highly recognized and iconic brand globally. It has built a strong brand image over the years, which helps in attracting customers and driving sales.

Diversified menu: McDonald's offers a diverse menu with a wide range of options, catering to different tastes and preferences. This allows them to attract a broader customer base and adapt to changing consumer demands.

Operational efficiency: McDonald's has a well-established and efficient operating system, which enables them to maintain consistent quality, speed, and service across their restaurants. This efficiency helps them in delivering a consistent customer experience.

Strong franchising model: McDonald's operates on a franchising model, which allows them to expand rapidly without significant capital investment. Franchisees bear the cost and operational responsibilities, while McDonald's benefits from franchise fees and royalties

McDonalds OpportunityCommit to the Core menu by tapping into customer demand for the familiar and focusing on serving our iconic products such as our World Famous Fries, the Big Mac, our Chicken McNuggets and the McFlurry. Around the world, McDonald’s possesses 10 of these "billion-dollar brand equities." The Company will continue to improve on its classics by implementing a series of operational and formulation changes designed to deliver hotter, juicer, tastier burgers across the globe. While leaning into core icons like Chicken McNuggets, ongoing focus will include scaling emerging equities such as the McSpicy and McCrispy Chicken Sandwiches. The Company also continues to see a significant opportunity with coffee, demonstrated by markets leveraging the McCafé brand, customer experience, value and quality to drive long-term growth.

Expansion in emerging markets: McDonald's can capitalize on the growing middle-class populations and changing lifestyles in emerging markets, such as Africa region, China and India. These markets offer significant opportunities for growth and expansion.

Focus on healthier options: There is an increasing demand for healthier food choices. McDonald's can continue to enhance its menu with healthier alternatives, such as salads, grilled options, and organic ingredients, to attract health-conscious consumers.

Technology integration: McDonald's can leverage technology to improve customer experience and operational efficiency. This includes implementing self-order kiosks, mobile ordering and payment systems, and delivery services to cater to changing consumer preferences and convenience.

McDonald’s TreatsIntense competition: The fast-food industry is highly competitive, with numerous global and local players. McDonald's faces competition from both traditional fast-food chains and newer, innovative concepts, which could impact on its market share and profitability.

Changing consumer preferences: Consumer preferences and trends can change rapidly, and if McDonald's fails to adapt to these changes, it risks losing customers to competitors who offer more appealing options.

Regulatory pressures: McDonald's operates in multiple countries, each with its own regulations and policies related to labor, food safety, and advertising. Complying with these regulations can be challenging and costly, and changes in regulations can impact the company's operations and profitability.

McDonald’s Weakness

Health concerns: McDonald's has faced criticism for the nutritional value of its food offerings. As consumer preferences shift towards healthier options, McDonald's has had to adapt its menu to include healthier choices, but it still faces challenges in changing its perception as a fast-food chain associated with unhealthy food.

Dependence on franchisees: While the franchising model is a strength, it also poses a risk as McDonald's depends heavily on its franchisees for the consistent operation of its restaurants. If franchisees face financial or operational difficulties, it could impact McDonald's brand image and customer experience.

Vulnerability to market fluctuations: As a global company, McDonald's is exposed to currency exchange rate fluctuations, changes in labor costs, and economic downturns in different markets. Such factors can affect its profitability and financial performance.

Global presence: McDonald's is one of the world's largest fast-food chains, with a presence in over 100 countries. Its widespread network of restaurants gives it a significant advantage over competitors.

Brand recognition: McDonald's is a highly recognized and iconic brand globally. It has built a strong brand image over the years, which helps in attracting customers and driving sales.

Diversified menu: McDonald's offers a diverse menu with a wide range of options, catering to different tastes and preferences. This allows them to attract a broader customer base and adapt to changing consumer demands.

Operational efficiency: McDonald's has a well-established and efficient operating system, which enables them to maintain consistent quality, speed, and service across their restaurants. This efficiency helps them in delivering a consistent customer experience.

Strong franchising model: McDonald's operates on a franchising model, which allows them to expand rapidly without significant capital investment. Franchisees bear the cost and operational responsibilities, while McDonald's benefits from franchise fees and royalties

McDonalds OpportunityCommit to the Core menu by tapping into customer demand for the familiar and focusing on serving our iconic products such as our World Famous Fries, the Big Mac, our Chicken McNuggets and the McFlurry. Around the world, McDonald’s possesses 10 of these "billion-dollar brand equities." The Company will continue to improve on its classics by implementing a series of operational and formulation changes designed to deliver hotter, juicer, tastier burgers across the globe. While leaning into core icons like Chicken McNuggets, ongoing focus will include scaling emerging equities such as the McSpicy and McCrispy Chicken Sandwiches. The Company also continues to see a significant opportunity with coffee, demonstrated by markets leveraging the McCafé brand, customer experience, value and quality to drive long-term growth.

Expansion in emerging markets: McDonald's can capitalize on the growing middle-class populations and changing lifestyles in emerging markets, such as Africa region, China and India. These markets offer significant opportunities for growth and expansion.

Focus on healthier options: There is an increasing demand for healthier food choices. McDonald's can continue to enhance its menu with healthier alternatives, such as salads, grilled options, and organic ingredients, to attract health-conscious consumers.

Technology integration: McDonald's can leverage technology to improve customer experience and operational efficiency. This includes implementing self-order kiosks, mobile ordering and payment systems, and delivery services to cater to changing consumer preferences and convenience.

McDonald’s TreatsIntense competition: The fast-food industry is highly competitive, with numerous global and local players. McDonald's faces competition from both traditional fast-food chains and newer, innovative concepts, which could impact on its market share and profitability.

Changing consumer preferences: Consumer preferences and trends can change rapidly, and if McDonald's fails to adapt to these changes, it risks losing customers to competitors who offer more appealing options.

Regulatory pressures: McDonald's operates in multiple countries, each with its own regulations and policies related to labor, food safety, and advertising. Complying with these regulations can be challenging and costly, and changes in regulations can impact the company's operations and profitability.

McDonald’s Weakness

Health concerns: McDonald's has faced criticism for the nutritional value of its food offerings. As consumer preferences shift towards healthier options, McDonald's has had to adapt its menu to include healthier choices, but it still faces challenges in changing its perception as a fast-food chain associated with unhealthy food.

Dependence on franchisees: While the franchising model is a strength, it also poses a risk as McDonald's depends heavily on its franchisees for the consistent operation of its restaurants. If franchisees face financial or operational difficulties, it could impact McDonald's brand image and customer experience.

Vulnerability to market fluctuations: As a global company, McDonald's is exposed to currency exchange rate fluctuations, changes in labor costs, and economic downturns in different markets. Such factors can affect its profitability and financial performance.

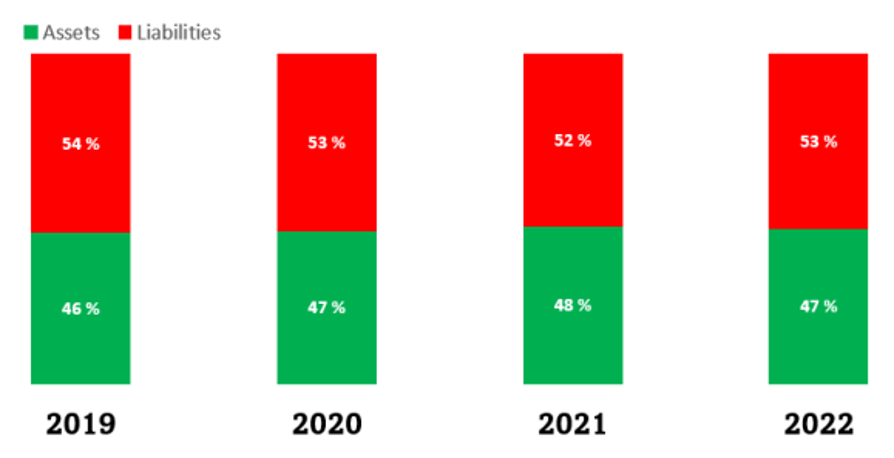

McDonald's Financial Health

McDonald's Corporation has generally been considered financially healthy. Here are some key points regarding McDonald's financial health: Revenue and profitability: McDonald's has consistently generated significant revenue and maintained a strong level of profitability. Its global presence and brand recognition have contributed to its ability to generate sales and drive profitability. McDonald's operates primarily on a franchising model, which has proven to be financially beneficial. Franchisees contribute to the company's revenue through franchise fees and ongoing royalties, while also bearing the costs of operating individual restaurants. This model allows McDonald's to expand without significant capital expenditure and helps in maintaining a steady cash flow. As today McDonald’s have a strong cash flow: McDonald's has historically demonstrated strong cash flow generation, which is essential for supporting

ongoing operations, investing in new initiatives, and returning value to shareholders through dividends and share repurchases. Adaptability, investment in technology and innovation, McDonald's has been investing in technology initiatives to enhance customer experience and operational efficiency. This includes digital ordering and payment systems, self-order kiosks, and delivery services. Such investments can position the company for future growth and competitiveness. However, it’s important to note that while McDonald's has generally maintained a strong financial position, it faces challenges and risks that can impact its financial health. These include factors like changing consumer preferences, intense competition, and economic conditions in different markets and their liabilities are greater than their assets.

Managements

Chris Kempczinski (54 Y)

3.7 years average management tenure

US$17,770,514 Compensation

Mr. Christopher J. Kempczinski, also known as Chris, has been the President, Chief Executive Officer, and Director at McDonald's Corporation since November 1, 2019. He serves as an Independent Director at The Procter & Gamble Company since October 12, 2021. He served as President of USA at McDonald's Corporation since January 1, 2017, until 2019.

He served as President at McDonald's USA, LLC since January 01, 2017, until 2019. He served as Executive Vice President of Strategy, Business Development & Innovation at McDonald's Corporation since October 26, 2015, until December 2016. He first joined McDonald’s in 2015, overseeing global strategy, business development and innovation. He oversaw all aspects of strategy development, planning, innovation, and new concepts to drive growth for the company.

He served as the President of International and Executive Vice President of Growth Initiatives at Kraft Foods Group, Inc., since February 12, 2015, until September 2015. He served as the President of Kraft Canada Inc since July 2012 until December 2014 and served as Senior Vice President - U.S. Grocery from December 2008 to July 2012. Before joining McDonald, he held several leadership roles at The KraftHeinz Company (packaged food), including Executive Vice President at Kraft Foods Group, Inc since January 29, 2014 until February 2015.

He leads Kraft’s Canadian business unit overseeing all aspects of supply chain, sales, marketing, human resources and research, development, and quality. He has full P&L responsibility for the business including beloved brands such as Kraft Dinner, Kraft Peanut Butter, Cracker Barrel natural cheeses and Nabob coffee. During his time with Kraft Canada, he has led the business unit through transformative change with the separation from Mondelez International in October 2012 and later restructuring the organization’s resources to focus on simplification and innovation. He joined Kraft in 2008 as Senior Vice President overseeing brands in the meals and enhancers categories with iconic brands like Kraft Macaroni & Cheese and Kraft dressings.

3.7 years average management tenure

US$17,770,514 Compensation

Mr. Christopher J. Kempczinski, also known as Chris, has been the President, Chief Executive Officer, and Director at McDonald's Corporation since November 1, 2019. He serves as an Independent Director at The Procter & Gamble Company since October 12, 2021. He served as President of USA at McDonald's Corporation since January 1, 2017, until 2019.

He served as President at McDonald's USA, LLC since January 01, 2017, until 2019. He served as Executive Vice President of Strategy, Business Development & Innovation at McDonald's Corporation since October 26, 2015, until December 2016. He first joined McDonald’s in 2015, overseeing global strategy, business development and innovation. He oversaw all aspects of strategy development, planning, innovation, and new concepts to drive growth for the company.

He served as the President of International and Executive Vice President of Growth Initiatives at Kraft Foods Group, Inc., since February 12, 2015, until September 2015. He served as the President of Kraft Canada Inc since July 2012 until December 2014 and served as Senior Vice President - U.S. Grocery from December 2008 to July 2012. Before joining McDonald, he held several leadership roles at The KraftHeinz Company (packaged food), including Executive Vice President at Kraft Foods Group, Inc since January 29, 2014 until February 2015.

He leads Kraft’s Canadian business unit overseeing all aspects of supply chain, sales, marketing, human resources and research, development, and quality. He has full P&L responsibility for the business including beloved brands such as Kraft Dinner, Kraft Peanut Butter, Cracker Barrel natural cheeses and Nabob coffee. During his time with Kraft Canada, he has led the business unit through transformative change with the separation from Mondelez International in October 2012 and later restructuring the organization’s resources to focus on simplification and innovation. He joined Kraft in 2008 as Senior Vice President overseeing brands in the meals and enhancers categories with iconic brands like Kraft Macaroni & Cheese and Kraft dressings.

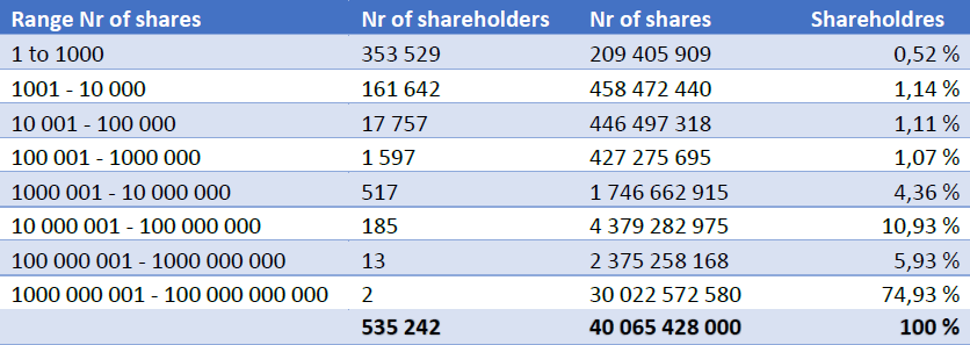

Ownership

- Institutions: 70 %

- General Public: 29

- Individual Insiders: 0.21%

- Number of institutions holding shares: 3619

Top McDonalds's - Shareholders

Business

Bayer AG operates as a life science company worldwide, it is one of the world's leaders in designing, producing, and marketing,

The Consumer Health segment markets nonprescription over-the-counter medicines, medical products, medicated skincare products, nutritional supplements, and self-care solutions in dermatology, nutritional supplements, pain and cardiovascular risk prevention, digestive health, allergy, and cold and cough.

The Crop Science segment offers chemical and biological crop protection products, improved plant traits, seeds, digital solution, and pest and weed control products, as well as customer service for agriculture. This segment also provides

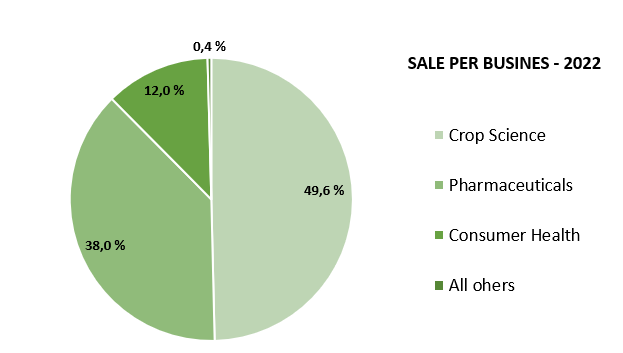

Net sales are distributed by product family as follows:

- Pharmaceutical products,

- Consumer Health, and

- Crop Science/agrochemicals.

The Consumer Health segment markets nonprescription over-the-counter medicines, medical products, medicated skincare products, nutritional supplements, and self-care solutions in dermatology, nutritional supplements, pain and cardiovascular risk prevention, digestive health, allergy, and cold and cough.

The Crop Science segment offers chemical and biological crop protection products, improved plant traits, seeds, digital solution, and pest and weed control products, as well as customer service for agriculture. This segment also provides

- breeding,

- propagation, and

- production/processing of seeds, including seed dressing.

Net sales are distributed by product family as follows:

- agrochemicals (49.6%): herbicides, fungicides, insecticides, etc.

- pharmaceutical products (37.9%): intended for the prevention and treatment of cardiovascular and respiratory diseases, diabetes, nervous system disorders, etc.;

- OTC products and nutritional supplements (12%);

- other (0.5%).

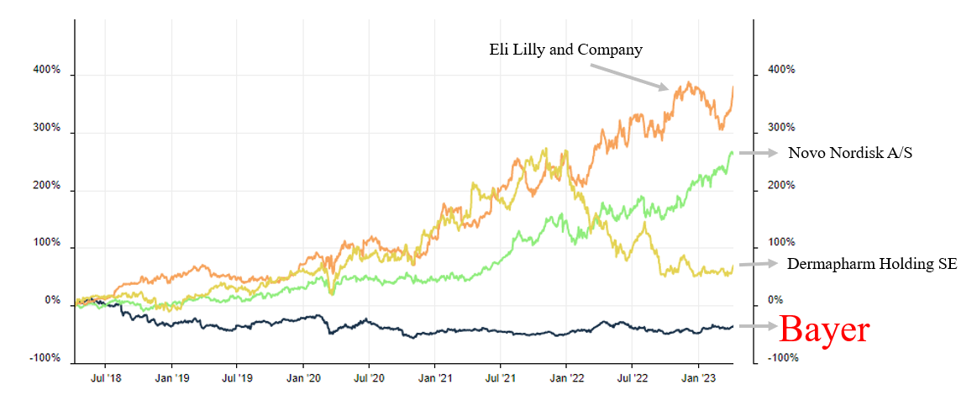

Bayer Brand’s Portfolio