- Individual Clients

- >

- Portfolio - construction & analysis

Portfolio - construction & analysis

$300.00

$300.00

Unavailable

per item

THE PORTFOLIO IS CONSTRUCTED USING TELA'S PRINCIPLES

POTENTIAL INVESTMENT CASES ARE EVALUATED THROUGH

A DISCIPLINES APPROACH

We understand there are many paths to success, and we know that each investor has different needs. Explore the way Tela helps investors build more sustainable portfolios. Our programs draw from a diverse range of asset classes, investment styles and investment managers, delivering solutions custom-made for you.

Our comprehensive portfolio analysis programs are designed to help chart prudent long-term strategies to guide you on the right investment path.

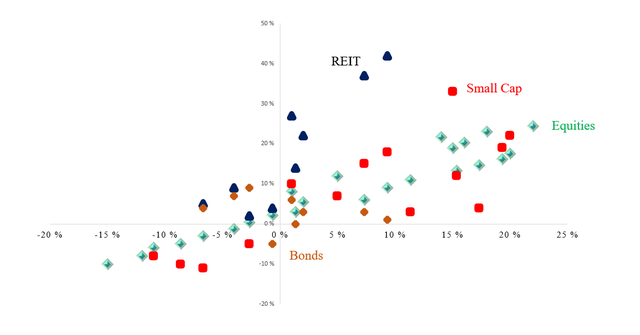

WHAT IS YOUR CURRENT PORTFOLIO ASSET ALLOCATION?

Do you find the road to achieving a solid portfolio is challenging and time consuming? We are committed to making it a rewarding journey, while helping you avoid costly mistakes along the way.

- Bottom-up focus on best ideas.

- Typically 9 - 16 companies.

- Sector diversification based on available investment cases.

- Liquidity and risk assessments.

POTENTIAL INVESTMENT CASES ARE EVALUATED THROUGH

- Fundamental company research.

- Comprehensive financial modeling based on our own assumptions.

- Evaluating management through reading.

A DISCIPLINES APPROACH

We understand there are many paths to success, and we know that each investor has different needs. Explore the way Tela helps investors build more sustainable portfolios. Our programs draw from a diverse range of asset classes, investment styles and investment managers, delivering solutions custom-made for you.

Our comprehensive portfolio analysis programs are designed to help chart prudent long-term strategies to guide you on the right investment path.

WHAT IS YOUR CURRENT PORTFOLIO ASSET ALLOCATION?

Do you find the road to achieving a solid portfolio is challenging and time consuming? We are committed to making it a rewarding journey, while helping you avoid costly mistakes along the way.

SKU: