101 – Equity analyst mentorship program

Overview:

Welcome to the most comprehensive, dynamic, and practical equity analyst mentorship program tailored specifically for retail investors. Unlike other courses that cater to institutional investors, our focus at Tela Equity Research is on empowering the retail segment, the most overlooked group who greatly benefit from dedicated support in navigating the investment landscape.

What You Will Learn:

- Fundamental Analysis: Dive deep into financial statements and learn how to interpret various financial ratios. Understand balance sheets, liquidity, profitability, and growth metrics to make informed investment decisions.

- Stock Valuation Techniques: Design and build your own stock valuation system from scratch, learning the methodologies that professional analysts use to evaluate stock worth.

- Data Acquisition: Gain insights on where to find reliable and up-to-date financial data essential for analysis.

- Understanding Economic Policies: Learn the intricacies of fiscal and monetary policies and how they influence the market and investment decisions.

Program Duration:

- This is a year-long mentorship program spread over 52 weeks, designed to build your expertise progressively with continuous support and feedback.

Target Audience:

- This course is ideal for anyone interested in the stock market, including new investors, students, or working professionals looking to enhance their knowledge and investment strategies.

Requirements:

- A willingness to learn and engage actively with course materials.

- Access to a computer with Excel installed, for financial analysis and modeling.

- A commitment to maintain consistency in learning and applying new skills throughout the duration of the program.

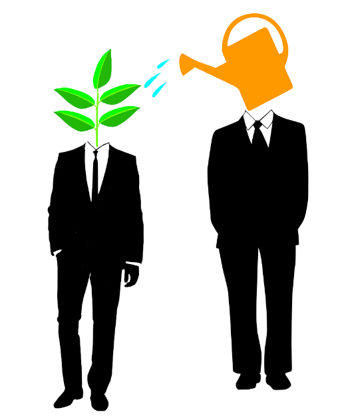

Why Join This Mentorship Program?

- Prepare for the Future: Equip yourself with the necessary skills.

- Reinforce Learning: Solidify your understanding of stock market valuation through practical application and expert guidance.

- Exceptional Support: Benefit from a dedicated support system to help you navigate complex concepts and strategies, enhancing your learning experience.

This mentorship program is designed not just to teach you about equity analysis but also to transform you into a skilled investor capable of making strategic decisions in the dynamic world of stock markets. Whether you're starting from scratch or looking to deepen your existing knowledge, this program will provide a wealth of insights and practical experience to propel your investing journey forward.